Consultant – Survey – Research – Report

Head office: Sukamanah RT. 04/06 Cisaat Sukabumi West Java – INDONESIA

Branch office: Kompleks Deppen Blok X/3 Harjamukti Cimanggis – Kota Depok - INDONESIA

Website: http://commercialglobaldataresearch.blogspot.com/

Pelanggan yang kami cintai! Salam sejahtera.

Semoga kita semua ada dalam lindungan Tuhan!

Latar Belakang Commercial Global Data Research (CDR)

Kami adalah sebuah lembaga Konsultan, Survey, Riset dan Pelaporan di bidang data riset secara global, menyajikan berbagai informasi bisnis aktual yang meliputi sektor Industri manufaktur, pertambangan, perbankan, asuransi, studi kelayakan, dan jasa riset lainnya.

Kami hadir sebagai mitra konsultan Anda, untuk memberikan informasi aktual yang Anda perlukan guna menentukan arah kebijakan dalam mengembangkan perusahaan Anda. Salah satu produk buku studi yang kami tawarkan kepada Anda adalah “Buku Studi tentang Kondisi Pasar dan Prospek Industri Kopi di Indonesia, 2011.

Kami tawarkan Buku tersebut kepada Anda seharga Rp. 6.000.000 (Enam juta rupiah) atau US$ 800, guna membantu para pelaku bisnis pada Industri Kopi, membantu para Investor, membantu pihak Perbankan atau Kreditor, dan pihak lainnya yang terkait, dengan cara melihat peta kekuatan diantara para pesaing/partner Anda, baik pesaing dari luar negeri maupun dalam negeri, mempelajari perkembangan Ekspor dan Impor produk Kopi di Indonesia, mengetahui hambatan dan peluang bagi perusahaan yang kondisinya berfluktuasi, mengetahui Main Market dari setiap perusahaan Kopi, mengetahui pangsa pasar luar negeri, mengetahui susunan Direktur dan Komisaris, serta informasi lainnya yang perlu Anda ketahui. (terlampir contoh Profil Perusahaan)!.

Seberapa besar kontribusi perusahaan Anda dalam meningkatkan kapasitas produksi guna memenuhi pesanan dari para buyer baik lokal maupun internasional, mencermati setiap peluang yang ada, dan diharapkan dengan memiliki buku ini, perusahaan Anda menjadi lebih produktif, efisien, lebih maju dan bersaing secara sehat.

Kata Pengantar

Kopi merupakan salah satu komoditas perkebunan yang mempunyai peran cukup penting dalam kegiatan perekonomian di Indonesia, karena merupakan salah satu komoditas ekspor andalan sebagai penghasil devisa negara di luar minyak dan gas. Selama lima tahun terakhir, Indonesia menempati posisi keempat sebagai negara eksportir kopi setelah Brazil, Kolombia dan Vietnam.

Terdapat dua spesies tanaman kopi, yaitu Arabika yang merupakan jenis kopi tradisional, dianggap paling enak rasanya, dan Robusta yang memiliki kafein lebih tinggi, dapat dikembangkan dalam lingkungan dimana kopi Arabika tidak akan tumbuh, dengan rasa pahit dan asam.

Di Indonesia, pada saat ini sekitar 95% tanaman kopi diusahakan oleh rakyat, sementara perkebunan Negara dan Swasta hanya berkontribusi masing-masing sebesar 3,13% dan 1,79%.

------------------------------------------------------------------------------------------------

DAFTAR ISI

BAB I PENDAHULUAN

1.1. Sejarah

1.2. Luas Areal dan Produksi

1.3. Mutu Kopi

1.4. Industri Kopi Indonesia

1.4.1. Perkembangan Kebutuhan Kopi

1.4.2. Pola Konsumsi Kopi

1.4.3. Struktur Industri Kopi Dalam Negeri

1.4.4. Keragaman Kemasan

1.4.5. Produksi Kopi Olahan

1.5. Sumber Data dan Informasi

BAB II PETA PRODUKSI KOPI DI INDONESIA

2.1. Perkebunan Kopi di Indonesia

2.1.1. Kopi Sumatera

2.1.2. Kopi Jawa

2.1.3. Kopi Bali

2.1.4. Kopi Timor

2.1.5. Kopi Sulawesi (Selatan)

2.1.6. Kopi Papua

2.2. Varietas Kopi

2.2.1. Kopi Arabika (Coffea arabica)

2.2.2. Kopi Liberika (Coffea Liberica)

BAB III PENGELOLAAN KOPI DI INDONESIA

3.1. Sistem Pengelolaan Kopi Kintamani Bali

3.2. Sistem Budidaya Kopi Petani Lampung

3.3. Sistem Budidaya kopi Petani Manggarai

3.4. Sistem Budidaya Kopi Petani Sidikalang

3.4.1. Proses pengolahan biji kopi secara umum

BAB IV PERKEMBANGAN PERDAGANGAN KOPI DUNIA

4.1. Konsumsi Kopi Dunia

4.1.1. Kopi ”Specialty”, kopi yang berkelanjutan

4.1.2. Sertifikasi kopi

BAB V RANTAI PERDAGANGAN KOPI

5.1. Beberapa model pemasaran

5.1.1. Model Pemasaran di Lampung

5.1.2. Model Pemasaran Kopi di Kabupaten Dairi

5.1.3. Model Pemasaran Kopi di Bali

5.1.3.1. Pihak dan peran aktor pemasaran/distribusi kopi di Bali

5.1.3.2. Temuan-Temuan yang Inovatif di Lapangan

5.1.4. Model Pemasaran Kopi di Kabupaten Manggarai

BAB VI KONDISI PASAR KOPI DI INDONESIA

6.1. Menengok Perkembangan Produksi dan Ekspor Kopi tempo dulu

6.1.1. Perkembangan Konsumsi dan Impor

6.1.2. Konsumsi per kapita di negara produsen pada umumnya masih sangat rendah

6.1.3. Perkembangan Harga

6.1.4. Perkembangan harga FOB Kopi Indonesia

6.1.5. Masalah, Tantangan dan Peluang

6.1.6. Kebijakan dan Strategi Pembangunan Perkopian Indonesia

6.1.7. Implikasi Kebijakan

6.2. Dua puluh empat anggota industri kopi Indonesia meraih Sertifikasi tertinggi dunia untuk pengujian kualitas

6.3. Harga secangkir kopi luwak di Korea Rp. 400.000

6.4. Peluang Pasar Produk Kopi Indonesia ke Australia

6.5. Perkembangan Ekspor Kopi Indonesia di Pasar Dunia

6.6. Kopi Indonesia diminati pasar internasional, tetapi kurang produktif

6.7. Genjot Produksi Kopi, Taman Delta Bantu Bibit

6.8. AEKI Sumsel Bangun Demplot Kopi Robusta

6.9. AEKI Kembali Lakukan Penetrasi Pasar ke China

6.10. Citra Kopi Indonesia

6.11. AEKI bantah kenaikan produksi kopi Indonesia

6.12. Orang Korea tergila-gila Kopi Luwak Indonesia

6.13. Pertumbuhan ekspor kopi masih negative

6.14. Analisis Prospek dan Strategi Pengembangan Industri Hilir Kopi

6.15. Ekspor Kopi ditargetkan meningkat 5% Tahun 2011

6.16. Nilai Ekspor Kopi Lampung Januari menurun

6.17. Mempromosikan Kopi Luwak Sebagai Komoditas Unggulan Indonesia

6.18. Ekspor Kopi Lampung ke Jepang belum terganggu

6.19. Gunawan Supriadi: Raja Kopi Luwak dari Liwa

6.20. Pasar Italia Menanti Kopi Arabica Indonesia

6.21. Pemasaran Industri Kopi Susu

6.22. Kondisi ekonomi Mesir tak stabil, ekspor kopi robusta longsor

6.23. Ekspor Kopi Lampung ke Jerman US$60,163 Juta

6.24. Ekspor kopi luwak ke Australia terhambat

6.25. Prediksi Harga Kopi 2011 Naik

6.26. Masalah, Tantangan dan Peluang Pengembangan Komoditas Kopi di Indonesia

6.27. Tren Kopi Mentah melonjak Harga Kopi Luwak Naik 20%

6.28. Surip Mawardi, Kopi telah mengantarkannya keliling Dunia ke 45 Negara

6.29. Ekspor Kopi Indonesia

6.29.1. Ekspor Kopi Instant HS Kode 2101111000-21011149000, 2009-2011

6.29.2. Ekspor Kopi Instant HS Kode 2101111000-21011149000 menurut Negara, 2011

6.29.3. Ekspor Kopi Bubuk tanpa Kafein HS Kode 0901120000-0901129000, 2007-2011

6.29.4. Ekspor Kopi Bubuk tanpa Kafein HS Kode 0901120000-0901129000 menurut Negara, 2011

6.29.5. Ekspor Kopi tidak digongseng HS Kode 0901111000-0901119000, 2007-2011

6.29.6. Ekspor Kopi tidak digongseng HS Kode 0901111000-0901119000 menurut Negara, 2011

6.29.7. Ekspor Kopi digongseng HS Kode 0901210000-0901212000, Tahun 2009-2011

6.29.8. Ekspor Kopi digongseng HS Kode 0901210000-0901212000 menurut Negara, Tahun 2011

6.29.9. Ekspor Kopi Olahan dengan dasar ekstrak, esens atau konsentrat atau olahan dengan dasar kopi HS Kode 2101120000, Tahun 2009-2011

6.29.10. Ekspor Kopi Olahan dengan dasar ekstrak, esens atau konsentrat atau olahan dengan dasar kopi HS Kode 2101120000 menurut Negara, Tahun 2011

6.29.11. Ekspor Kopi dihilangkan kafeinnya HS Kode 0901220000-0901900000, Tahun 2007-2011

6.29.12. Ekspor Kopi dihilangkan kafeinnya HS Kode 0901220000-0901900000 menurut Negara, Tahun 2011

6.30. Kopi Kapal Api Kuasai Pasar Domestik

6.31. Pemain Tua di Pasar Kopi

6.32. Orang Indonesia masih jarang minum Kopi

6.33. Peringatan 15 Tahun Kemitraan Nestle dalam Budidaya Kopi

6.34. Persaingan Industri Kopi Susu yang terus berkembang

6.34.1. Pokok Masalah

6.34.2. Alternatif Pemecahan Masalah

6.34.3. Rekomendasi Alternatif

6.34.4. Prospek dan Kendala Industri Kopi Indonesia

6.35. Peluang Produk Kopi Indonesia di Pasar Kanada

6.35.1. Jenis‐Jenis Kopi

6.35.2. Klasifikasi Kopi Berdasarkan HS Code

6.35.3. Pasar Kopi Domestik di Kanada

6.35.4. Pasar Luar Negeri

6.35.5. Trend

6.35.6. Isu dan Hambatan

6.35.7. Saluran Distribusi

6.35.8. Harga

6.35.9. Perundangan dan Peraturan

6.35.10. Pesaing

6.35.11. Peluang dan Tantangan

6.35.12. Strategi Penerobosan Pasar Kanada

6.36. Market Brief Produk Kopi di Pasar Hongaria

6.36.1. Jenis Produk Kopi

6.36.2. Potensi Pasar

6.36.3. Ekspor

6.36.4. Saluran Distribusi

6.36.5. Kisaran Harga

6.36.6. Strategi Pemasaran

6.36.7. Ketentuan Perdagangan

6.36.8. Peluang Dan Hambatan Perdagangan

6.36.9. Alamat penting di Kanada

6.36.10. Pameran di Kanada

BAB VII OUTLOOK INDUSTRI KOPI INDONESIA

7.1. Perkembangan luas areal, produksi dan produktivitas Kopi di Indonesia

7.2. Perkembangan Konsumsi Kopi di Indonesia

7.3. Perkembangan Harga Kopi di Indonesia

7.4. Perkembangan Ekspor Impor Kopi di Indonesia

7.5. Perkembangan Luas areal, Produksi, Produktivitas dan Konsumsi Kopi Dunia

7.6. Perkembangan Ekspor - Impor Kopi Dunia

7.7. Proyeksi Penawaran Kopi 2011

7.8. Proyeksi Permintaan Kopi 2011

7.9. Proyeksi Surplus/Defisit Kopi 2009 – 2011

7.10. Profil Perusahaan Industri Kopi Bubuk

7.10.1. Santos Jaya Abadi

7.10.2. PT. Ayam Merak

7.10.3. PT. Putra Bhineka Perkasa

BAB VIII STRATEGI PEMASARAN

8.1. Bauran Pemasaran

8.2. Strategi pemasaran

8.3. Strategi Marketing Mix Kopi Kapal Api

BAB IX ANALISIS SWOT

9.1. Analisis SWOT

9.2. Alternatif Strategi

9.3. Alternatif Kebijakan

BAB X KONDISI KOPI DI BEBERAPA NEGARA

10.1. Brazil

10.1.1. Produksi Kopi Brasil mengkerut 6%

10.1.2. Perkembangan Harga Kopi

10.1.3. Ekspor Kopi Brasil ke Dunia Arab tumbuh 44% pada bulan Maret

10.1.4. Ekspor Kopi Brasil tembus USD5,7 Miliar

10.1.5. Outlook Industri Kopi Brazil

10.2. Kolombia

10.2.1. Produksi kopi di Kolombia

10.2.2. Peningkatan Produksi dan Prospek Ekspor

10.3. Kostarika

10.3.1. Sejarah

10.3.2. Daerah pertumbuhan dan musim

10.3.3. Produksi Kopi terhadap Pencemaran Lingkungan

10.4. EAFCA (The Eastern African Fine Coffees Association)

10.4.1. Produksi Kopi di Daerah Pedalaman tahun 2008/2009

10.4.2. Biaya Produksi

10.4.3. Konsumsi kopi tumbuh secara cepat

10.4.4. Diharapkan Produksi Kopi tetap lancar seiring dengan permintaan yang meningkat

10.4.5. Prospek Industri Kopi EAFCA 2009/2010

10.4.6. Tentang EAFCA

10.5. Hawaii

10.5.1. Sejarah Produksi dan Kecenderungan

10.5.2. Sejarah Harga dan Kecenderungan

10.5.3. Produk pangsa pasar di Negara

10.5.4. Potensi Permintaan dan Tren Harga Pasar Ekspor

10.5.5. Pasar Asing

10.5.6. Pasar Jepang

10.5.7. Pasar asing lainnya

10.5.8. Faktor-faktor yang mempengaruhi permintaan

10.5.9. Kompetitif Negara

10.6. India

10.6.1. Produksi Kopi India

10.6.2. Sistem Pemasaran Kopi di India

10.7. Kenya

10.8. Mexico

10.9. Vietnam

10.9.1. Volume naik, Nilai turun

10.9.2. Pandangan mengenai Resiko

BAB XI PENUTUP

--------------------------------------------------------------------------

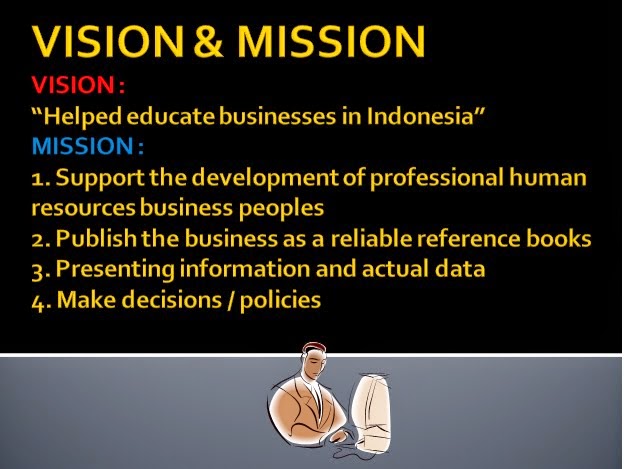

Background of Commercial Global Data Research (CDR)

We are an agency consultant, Survey, Research and Reporting in the field of global research data, presents a variety of actual business information that includes the Industrial sector, manufacturing, mining, banking, insurance, feasibility studies, and other research services.

We are here as your consultant partner, to provide the actual information you need to determine the policy direction in developing your company. One study book product that we offer to you is the "Book Study of Market Conditions and Prospects of the Coffee Industry in Indonesia, 2011.

We offer these books to you for Rp. 6,000,000 (six million rupiah) or $ 800, to assist business people in the coffee industry, helping investors, helping the banks or creditors, and other related parties, with how to view a map of power among competitors / partners you, good competitors from overseas and domestic, Export and Import of studying the development of coffee products in Indonesia, knowing the obstacles and opportunities for companies whose condition fluctuates, knowing the Main Market of every coffee company, know the market share abroad, knowing the composition of Directors and Commissioners, and Other information you need to know. (The attached sample Company Profile)!.

How big is your company's contribution in increasing production capacity to meet orders from buyers both locally and internationally, look at every available opportunity, and are expected to have this book, your company become more productive, efficient, more forward and compete fairly.

Preface

Coffee is one of the commodities that have a significant role in economic activities in Indonesia, because it is one of the mainstay of export commodities as a producer of foreign exchange outside the oil and gas. Over the last five years, Indonesia ranked fourth as the country's coffee exporter after Brazil, Colombia and Vietnam.

There are two species of coffee plants, namely Arabica coffee which is the traditional type, is considered the most delicious taste, and Robusta which has a higher caffeine, can be developed in an environment where Arabica coffee is not going to grow, with bitter and sour taste.

In Indonesia, at present approximately 95% of the coffee plants cultivated by the people, while the State and private plantations contribute only amounted to 3.13% and 1.79%.

------------------------------------------------------------------------------------------------

CHAPTER I INTRODUCTION

1.1. History

1.2. Area and Production

1.3. Quality Coffee

1.4. Indonesian Coffee Industry

1.4.1. Development Needs Coffee

1.4.2. Coffee Consumption Pattern

1.4.3. Domestic Coffee Industry Structure

1.4.4. Diversity Packaging

1.4.5. Processed Coffee Production

1.5. Sources of Data and Information

CHAPTER II MAP PRODUCTION IN INDONESIA COFFEE

2.1. Coffee Plantation in Indonesia

2.1.1. Sumatra Coffee

2.1.2. Java Coffee

2.1.3. Bali Coffee

2.1.4. Coffee East

2.1.5. Coffee Sulawesi (South)

2.1.6. Papua Coffee

2.2. Coffee Varieties

2.2.1. Arabica coffee (Coffea arabica)

2.2.2. Liberika coffee (Coffea Liberica)

CHAPTER III MANAGEMENT OF COFFEE IN INDONESIA

3.1. Bali Kintamani Coffee Management System

3.2. Lampung Coffee Farmers Farming Systems

3.3. Coffee Farmers Farming Systems Manggarai

3.4. Coffee Farmers Farming Systems Sidikalang

3.4.1. The processing of coffee beans in general

CHAPTER IV THE GROWTH OF WORLD TRADE COFFEE

4.1. World Coffee Consumption

4.1.1. Coffee "Specialty", sustainable coffee

4.1.2. Coffee Certification

CHAPTER V TRADE COFFEE CHAIN

5.1. Some marketing models

5.1.1. Marketing Models in Lampung

5.1.2. Coffee Marketing Models in Dairi district

5.1.3. Bali Coffee Marketing Model

5.1.3.1. Parties and the role of actor marketing / distribution of coffee in Bali

5.1.3.2. Innovative Findings in the Field

5.1.4. Coffee Marketing Models in Manggarai regency

CHAPTER VI CONDITIONS OF COFFEE MARKET IN INDONESIA

6.1. A Look at Production and Export of Coffee tempo

6.1.1. Consumption and Import Growth

6.1.2. Consumption per capita in the country of manufacture are generally still very low

6.1.3. Price Development

6.1.4. The development of the FOB price of Indonesian Coffee

6.1.5. Problems, Challenges and Opportunities

6.1.6. Policy and Strategy Development Indonesian Coffee

6.1.7. Policy Implications

6.2. Twenty-four members of Indonesia's coffee industry achieve world's highest certification for quality testing

6.3. Civet coffee prices in Korea USD. 400.000

6.4. Indonesia Coffee Products Market Opportunities for Australia

6.5. Indonesian Coffee Exports in the World Market

6.6. Coffee Indonesia international market demand, but less productive

6.7. Increase Coffee Production, Delta Park Seed Help

6.8. AEKI South Sumatra Robusta Coffee Wake up demonstration plots

6.9. Do AEKI Back to the China Market Penetration

6.10. The image of Indonesian Coffee

6.11. AEKI denies Indonesia's coffee production increase

6.12. Those crazy Koreans Indonesian Luwak Coffee

6.13. Coffee export growth was still negative

6.14. Prospect Analysis and Strategy Development Downstream Coffee

6.15. Coffee exports are targeted increase of 5% Year 2011

6.16. Value of Coffee Exports in January declined Lampung

6.17. Promote Coffee Luwak As Commodities Commodity Indonesia

6.19. Gunawan Supriya: King Coffee Luwak from Liwa

6.20. Italian Market Awaits Indonesian Arabica Coffee

6.21. Coffee Milk Marketing Industry

6.22. Unstable economic conditions of Egypt, robusta coffee exports landslide

6.23. Lampung Coffee Exports to Germany to U.S. $ 60.163 Million

6.24. Civet coffee exports to Australia hampered

6.25. Coffee Prices Rise Prediction 2011

6.26. Problems, Challenges and Opportunities in Indonesia Coffee Commodities Development

6.27. Trends in Raw Coffee Luwak Coffee prices surged 20% Rise

6.28. Surip Mawardi, coffee has been delivered to 45 countries around the World

6.29. Indonesia Coffee Export

6.29.1. Instant Coffee Exports 2101111000-21011149000 HS Code, 2009-2011

6.29.2. Instant Coffee Exports HS Code 2101111000-21011149000 by Country, 2011

6.29.3. Export Coffee without Caffeine Powder 0901120000-0901129000 HS Code, 2007-2011

6.29.4. Export Coffee without Caffeine Powder 0901120000-0901129000 HS Code by Country, 2011

6.29.5. Export Coffee not roasted 0901111000-0901119000 HS Code, 2007-2011

6.29.6. Coffee not roasted Exports HS Code 0901111000-0901119000 by Country, 2011

6.29.7. Roasted Coffee Exports HS Code 0901210000-0901212000, Year 2009-2011

6.29.8. Roasted Coffee Exports HS Code 0901210000-0901212000 by Country, Year 2011

6.29.9. Coffee Export Preparations with a basis of extracts, essences or concentrates or with a basis of coffee HS Code 2101120000, Year 2009-2011

6.29.10. Coffee Export Preparations with a basis of extracts, essences or concentrates or with a basis of coffee HS Code 2101120000 by Country, Year 2011

6.29.11. Decaffeinated coffee exports 0901220000-0901900000 HS Code, Year 2007-2011

6.29.12. Decaffeinated coffee exports 0901220000-0901900000 HS Code by Country, Year 2011

6.30. Kapal Api Coffee Master the Domestic Market

6.31. Old players in the Coffee Market

6.32. Indonesian people are still rarely drink coffee

6.33. 15th Anniversary of Partnership Nestle Coffee Cultivation

6.34. Milk Coffee Industry Competition growing

6.34.1. Main Issues

6.34.2. Alternative Troubleshooting

6.34.3. Alternative Recommendation

6.34.4. Prospects and Constraints of Indonesian Coffee Industry

6.35. Indonesia Coffee Products Opportunity in Canada Market

6.35.1. Coffee Types

6.35.2. HS Code Classification Based Coffee

6.35.3. Domestic Coffee Market in Canada

6.35.4. Foreign Markets

6.35.5. Trend

6.35.6. Issues and Barriers

6.35.7. Distribution Channels

6.35.8. Price

6.35.9. Legislation and Regulation

6.35.10. Competitors

6.35.11. Opportunities and Challenges

6.35.12. Tunneling Canadian Market Strategies

6.36. Market Brief Product Market Coffee in Hungary

6.36.1. Coffee Product Type

6.36.2. Market Potential

6.36.3. Export

6.36.4. Distribution Channels

6.36.5. Price Range

6.36.6. Marketing Strategy

6.36.7. Terms of Trade

6.36.8. Opportunities and Barriers to Trade

6.36.9. Important address in Canada

6.36:10. Exhibitions in Canada

CHAPTER VII INDONESIA COFFEE INDUSTRY OUTLOOK

7.1. Development of acreage, production and productivity in the Indonesian Coffee

7.2. Coffee Consumption Growth in Indonesia

7.3. Coffee Price Development in Indonesia

7.4. Coffee Import Export Growth in Indonesia

7.5. Area Development, Production, Productivity and the World Coffee Consumption

7.6. Development of Export - Import World Coffee

7.7. Projected 2011 Coffee Offer

7.8. Coffee Demand Projections 2011

7.9. Projected Surplus / Deficit Coffee 2009 – 2011

7.10. Coffee Powder Industries Company Profile

7.10.1. Santos Jaya Abadi

7.10.2. PT. Peacock Chicken

7.10.3. PT. Bhineka Putra Perkasa

CHAPTER VIII MARKETING STRATEGY

8.1. Marketing Mix

8.2. Marketing strategy

8.3. Marketing Strategy Kapal Api Coffee Mix

CHAPTER IX SWOT ANALYSIS

9.1. SWOT Analysis

9.2. Alternative Strategies

9.3. Alternative Policies

CHAPTER X THE CONDITION OF COFFEE IN SOME COUNTRIES

10.1. Brazil

10.1.1. Brazil Coffee Production shrank 6%

10.1.2. Coffee Price Development

10.1.3. Brazil Coffee Exports to Arab World grew 44% in March

10.1.4. Brazil Coffee Exports translucent USD5, 7 Billion

10.1.5. Brazilian Coffee Industry Outlook

10.2. Colombia

10.2.1. Coffee production in Colombia

10.2.2. Increased Production and Export Prospects

10.3. Kostarika

10.3.1. History

10.3.2. Regional growth and season

10.3.3. Coffee Production on Environmental Pollution

10.4. EAFCA (The Eastern African Fine Coffees Association)

10.4.1. Coffee Production in Rural Areas year 2008/2009

10.4.2. Production Costs

10.4.3. Coffee consumption grows rapidly

10.4.4. Coffee Production Expected remains smooth along with the increased demand

10.4.5. EAFCA Coffee Industry Prospects 2009/2010

10.4.6. About EAFCA

10.5. Hawaii

10.5.1. Production History and Trends

10.5.2. Historical Prices & Trends

10.5.3. Product market share in State

10.5.4. Potential Demand and Price Trends of Export Markets

10.5.5. Foreign Markets

10.5.6. Japan Markets

10.5.7. Other foreign markets

10.5.8. Factors affecting demand

10.5.9. Competitive State

10.6. India

10.6.1. India Coffee Production

10.6.2. Coffee Marketing System in India

10.7. Kenya

10.8. Mexico

10.9. Vietnam

10.9.1. Volume up, value down

10.9.2. This view of risk

CHAPTER XI CLOSING

--------------------------------------------------------------------------------

SANTOS JAYA ABADI, PT

A d d r e s s : Head Office & Factory

Jl. Taman Jatibaru Barat No. 1-3

Jakarta Pusat 10150 Indonesia

Phone : +62 (021) 3857451

Fax : +62 (021) 3805835

Customer Service : 0800-1-726867

Email : santos@kapalapi.co.id,

mktsja@kapalapi.co.id,

sdm@kapalapi.co.id

Website : kapalapi.co.id

S t a t u s : Domestic Private Company

Condition of Company : Good

Date of Establishment : 1 9 2 7

Line of Business : - Coffee Powder

- Extracts, Essences And Concentrates of Coffee

- Tea and Coffee Processing

Products : a. Coffee (Kapal Api, ABC, Good Day, Excelso, Ya)

b. Cereal (Ceremix)

Instant cereal mix market is another attractive market that PT Santos Jaya Abadi viewed as offering an opportunity for product line extension. As a new type of product for Indonesian market, instant cereal mix has and is experiencing a vast growth in the last few years.

In 2005, PT Santos Jaya Abadi launched our instant cereal mix product with the brand Ceremix. Ceremix offers good quality and delicious taste product, very suitable for breakfast and in between meals and packed individually for serving practicality purpose. Ceremix is a hi-nutritious instant cereal mix drink. It contains Carbohydrate, Calcium, Fiber, Minerals and Vitamins that give you energy to support your daily activities. Ceremix is available in two delightful variants, Chocolate and French Vanilla.

c. Café

As one of the world’s largest coffee – producing nations, Indonesia still has a very low per capita coffee consumption which is deplorable. This situation calls for innovative measures that led to the creation of Kapal Api Group’s coffee shop chains.

Kafe Excelso

Formed in the middle of 1990, Café Excelso was born as a division of PT Excelso Multi Rasa. This division is now serving as the marketing system extension of PT Santos Jaya Abadi with the purpose of ensuring the complete satisfaction of our consumers.

Café Excelso opened its first location in Plaza Indonesia, Jakarta in 1991 and is the premier coffeehouse of Indonesia with more than 40 locations throughout the nation.

Café Grazia

The latest innovation of PT Santos Jaya Abadi was Grazia Café, this coffee shop was born in the heart location of our company, Surabaya. It opened its first outlet in 2004 in Golden City Mall, one of the latest shopping centres opened in West Surabaya area.

Shortly after the success of the1st outlet, the second and third outlet was opened in East and Central Surabaya. The general idea behind the project is the understanding that it has become indispensable to provide a great coffee experience to all type of customers. Our goal is to continuously build upon the quality of our products, customer service, and the store ambience and to extend the coffee experience to younger and new generation of coffee lovers.

Every Grazia café is an Oasis—with an inviting, comfortable atmosphere of warm colours and cozy furniture, everyone can find a place to sit and sip, laugh with a dear friend, make progress on some pressing assignment without distraction or just relax. Grazia Café combines the best varieties of European, Chinese and Indonesian meal with great-tasting, high-quality specialty coffee beverages.

Award & Certificate : Award

- Indonesian Customer Satisfaction Award (2001 to 2007)

- The Most Powerful Distribution System (2006 to 2007)

- Indonesian Best Brand Award (2002 to 2007)

- Anugerah Produksi Asli Indonesia (2006)

- Packaging Consumer Branding Award (2005)

- Indonesia Good Design Selection (2002)

- Top Brand Award ABC (2003 t0 2007)

- Top Brand Award Kapal Api (2000 to 2007)

- Merk Dagang Indonesia (2003)

Certificate : - ISO 9001:2000

- Hazard Analysis and Critical Control Point (HACCP)

- Good Manufacturing Practice (GMP)

Main Markets : China, Hong Kong, Japan,

United Arab Emirates, USA

Employment : 200-300 Peoples

“Everything we do has to be as good as our coffee.” It’s not just about coffee…it’s also about people, too. We don’t just make great coffee, we provide one-of-a-kind career opportunities.

We believe in evolving our organization by attracting and developing people with potential — leaders who are ambitious, talented, passionate about our coffee, and enthusiastic about our growth and theirs.

PT Santos Jaya Abadi offers great opportunities in Marketing, Supply Chain, Manufacturing, IT, R&D, Technical, Finance and Administrative functions in locations throughout Indonesia and South-East Asia.

Board of Management : - Mr. Indra Boedijono (President Commissioner), Phone: (62-21) 3857451

- Mr. Soedomo Mergonoto (Presiden Director) Phone: (62-21) 3857451

Contact Person : Mr. Danyantono - Phone: (62-21) 3857451

R E M A R K :

About Us

PT Santos Jaya Abadi is steeped in tradition as rich as its coffee. As the largest family-owned coffee brand in Indonesia, our company’s roots grew from a small home industry company in Surabaya. Where more than 79 years ago in 1927, our founder Go Soe Loet produced his popular coffee.

Shortly thereafter, the company began producing coffee using the trade mark “Kapal Api” (Steam Ship), drawing its inspiration from the steam ship which at that time was the symbol of technological superiority and a mark of luxury. Inspired by idea of always aiming at quality, the business has made a fast and steady progress.

In 1970 our company evolved the organisation. The second generation emerged to guarantee the continuation and success of the business by introducing state of art changes in the Machineries and equipments, people skill and management and the expansion of the product availability to reach the entire East Java.

In 1980 we built our existing factory at Sepanjang, Sidoarjo in East Java. At this stage, Kapal Api brand has become the pillar of our business, distributed all across the country and has become the market leader with its complete range of products.

Following the success of Kapal Api brand and to obtain the maximum satisfaction of our consumers, PT Santos Jaya Abadi has introduced other successful brands into the market: Excelso, ABC, Good day, Ya and Kapten.

Today, PT Santos Jaya Abadi with its product range is so much a part of people’s lives and spans so many generations. We attribute this success to the good management, the thorough dedication of our staffs, and naturally to the service and excellent quality of our products.

------------------------------------------------------------------------------

Kirimkan kepada kami sejumlah (….) buku “STUDI TENTANG KONDISI PASAR DAN PROSPEK INDUSTRI KOPI DI INDONESIA”, 2011.

Send us a number of (……) the book "STUDY ON THE MARKET CONDITIONS AND PROSPECTS OF COFFEE INDUSTRY IN INDONESIA”, 2011.

Tanggal Pemesanan : ……………………………………………………………………

Booking date

Nama Pemesan : …………………………………………………………………………

Name of buyer

Jabatan : …………………………………………………………………………………

Position

Nama Perusahaan : ………………………………………………………………………

Name of Company

Alamat Perusahaan : ……………………………………………………………………

Company Address

Telepon/Fax : ……………………………………………………………………………

Phone/Fax

Email : …………………………………………………………………………………

Hubungi kami / Contact Us :

DENI SILALAHI (Marketing Department) “Commercial Global Data Research”

Address : Sukamanah RT. 04/06 Cisaat, Sukabumi, West Java – INDONESIA

Branch Office: Kompleks Deppen Blok X No. 3 Harjamukti Cimanggis - BOGOR

Phone : +62 (0266) 9296038 Fax: +62 (0266) 241346 Email: cg.dataresearch@gmail.com

Pembayaran melalui : √ : Cash : Cheque : Transfer

Payment via

Nama Bank : BANK OCBC NISP Cabang Sukabumi

Bank name

Nomor Rekening : 14081015480-1

Account number

Rekening atas nama : ROHIYAH

Account in the name

Buku pesanan Anda akan segera kami kirim setelah ada konfirmasi dari pihak pemesan.

Book your order will immediately tell us when there is confirmation from the buyer

Terima kasih atas kepercayaan anda bermitra dengan kami.

Thank you for the trust you partner with us.

Hormat kami/sincerely

Pemesan/Buyer

Signature,

(.......................................)

--------------------------------------------------------------------------