NEW PRODUCTS...!

STUDI TENTANG KONDISI PASAR DAN PROSPEK

INDUSTRI PULP DAN KERTAS DI INDONESIA, 2013

STUDY ON THE MARKET CONDITIONS AND PROSPECT

OF PULP AND PAPER INDUSTRY IN INDONESIA, 2013

INDONESIA AND ENGLISH VERSION

Pelanggan yang kami cintai! Salam sejahtera.

Semoga kita semua ada dalam lindungan Tuhan!

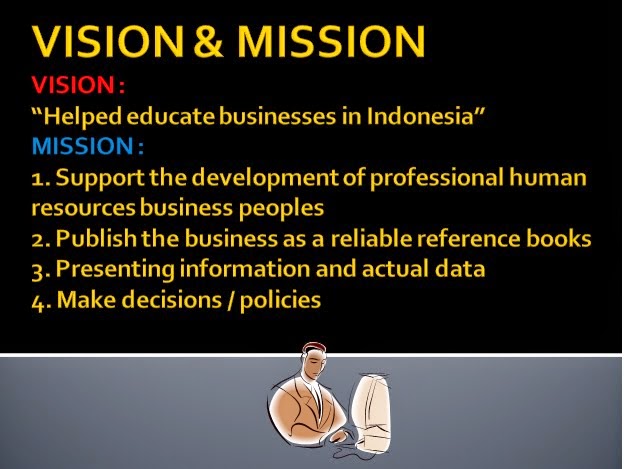

Latar Belakang Commercial Global Data Research (CDR)

Kami adalah sebuah lembaga Konsultan, Survey, Riset dan Pelaporan di bidang data riset secara global, menyajikan berbagai informasi bisnis aktual yang meliputi sektor Industri manufaktur, pertambangan, perbankan, asuransi, studi kelayakan, dan jasa riset lainnya.

Kami hadir sebagai mitra konsultan Anda, untuk memberikan informasi aktual yang Anda perlukan guna menentukan arah kebijakan dalam mengembangkan perusahaan Anda. Salah satu produk buku studi yang kami tawarkan kepada Anda adalah “Buku Studi tentang Kondisi Pasar dan Prospek Industri Pulp dan Kertas di Indonesia, 2013.

Kami tawarkan Buku tersebut kepada Anda seharga Rp. 7.000.000 (Tujuh juta rupiah), guna membantu para pelaku bisnis pada Industri Pulp dan Kertas, membantu para Investor, membantu pihak Perbankan atau Kreditor, dan pihak lainnya yang terkait, dengan cara melihat peta kekuatan diantara para pesaing/partner Anda, baik pesaing dari luar negeri maupun dalam negeri, mempelajari perkembangan Ekspor dan Impor produk Pulp dan Kertas di Indonesia, mengetahui hambatan dan peluang bagi perusahaan yang kondisinya berfluktuasi, mengetahui Main Market dari setiap perusahaan Pulp dan Kertas, mengetahui pangsa pasar luar negeri, mengetahui susunan Direktur dan Komisaris, serta informasi lainnya yang perlu Anda ketahui. (terlampir contoh Profil Perusahaan).

Seberapa besar kontribusi perusahaan Anda dalam meningkatkan kapasitas produksi guna memenuhi pesanan dari para buyer baik lokal maupun internasional, mencermati setiap peluang yang ada, dan diharapkan dengan memiliki buku ini, perusahaan Anda menjadi lebih produktif, efisien, lebih maju dan bersaing secara sehat.

-----------------------------------------------------------------------

KATA PENGANTAR

Industri Agro memiliki peranan strategis dalam struktur industri dan ekonomi Indonesia. Hal ini dapat dilihat dari kontribusi Industri Agro dalam PDB, ekspor, dan penyerapan tenaga kerja. Peranan lainnya adalah dalam hal mendukung ketahanan pangan, mendukung pengembangan ekonomi dan pemerataan industri ke seluruh wilayah Indonesia.

Perkembangan industri selama ini telah menunjukkan kemajuan-kemajuan, namun belum optimal sebagaimana diharapkan. Hal ini disebabkan berbagai tantangan dan permasalahan yang dihadapi, antara lain:

1. Masih berbasis comparative advantage;

2. Kelangkaan bahan baku, karena banyak diekspor dalam bentuk produk primer;

3. Persaingan yang semakin ketat;

4. Adanya hambatan tarif dan non tarif, sehingga masih diperlukan upaya pengembangan melalui berbagai kebijakan dan program yang efektif

Khusus untuk Industri Pulp dan Kertas di Indonesia, dewasa ini sedang tumbuh dan berkembang dengan pesat sejalan dengan meningkatnya konsumsi pemakaian pulp dan kertas. Perkembangan industri ini akan terus meningkat dan ditunjang pula oleh keberadaan Indonesia yang memiliki keunggulan komparatif, antara lain adanya potensi hutan yang luas untuk penyediaan kayu sebagai bahan baku. Potensi ini akan bertambah dengan adanya program pembangunan. Hutan Tanaman Industri (HTI) yang kini sedang digalakkan pelaksanaannya. Demikian pula tersedianya bahan baku serat bukan kayu yang cukup melimpah.

Industri Pulp dan Kertas juga merupakan salah satu industri yang mempunyai peranan penting dan merupakan produk unggulan dalam menunjang perekonomian Indonesia. Ada 3 alasan utama yang melatarbelakangi pentingnya sumbangan industri ini, Pertama: produk pulp dan kertas harganya banyak ditentukan dalam nilai dolar; Kedua: komponen impor yang digunakan dalam proses produksi nilainya tidak lebih dari 30%; dan Ketiga: produk pulp dan kertas cenderung banyak yang ditujukan untuk pasar ekspor. Sehingga dalam masa krisis ekonomi global yang dihadapi Indonesia saat itu, industri ini masih dapat diandalkan dalam membantu penerimaaan devisa negara.

Pentingnya industri pulp dan kertas yang besar tidak terlepas dari kondisi yang dimilikinya. Sampai saat ini industri pulp dan kertas Indonesia memiliki keunggulan komparatif dibandingkan dengan negara lain. Keunggulan yang lebih banyak mengandalkan sumber bahan baku yang berlimpah dengan harga yang relatif murah serta tenaga kerja dengan upah buruh yang relatif rendah. Dalam hal bahan baku misalnya, Indonesia termasuk negara penyedia bahan baku pulp terbesar, karena mempunyai hutan terluas kedua di dunia. Sehingga bahan baku (kayu) untuk pembuatan pulp dan kertas tersedia banyak di Indonesia. Begitu juga dalam hal tenaga kerja, angkatan kerja produktif di Indonesia mencapai puluhan juta orang. Keunggulan komparatif tersebut sebagai akibat dari kondisi alam dan demografi. Tetapi keuntungan komparatif belum merupakan syarat cukup untuk bisa bersaing dimasa mendatang. Untuk mampu berkompetisi dengan industri sejenis dari negara lain dimasa mendatang, maka keunggulan komparatif harus ditingkatkan menjadi keunggulan kompetitif. Keunggulan kompetitif ini akan lebih mengandalkan kepada inovasi produk, proses dan jasa, penggunaan teknologi yang ramah lingkungan, perluasan pasar serta benchmarking dengan perusahaan bereputasi internasional.

Dilihat dari pangsa produksi dan ekspor penguasaan jaringan pasar luar negeri, masih menjadi kelemahan bagi sebagian besar produsen pulp dan kertas Indonesia. Meskipun demikian, beberapa (group) perusahaan telah mencoba menembus pasar luar negeri, terutama pasar Asia, dengan melakukan ekspansi ke negara-negara di kawasan ini. Kelompok Sinar memasuki pasar Asia dengan mendirikan kelompok perusahaan melalui bendera APP (Asia Pulp and Paper) di Singapura, China, Malaysia, dan India. Begitu juga dengan keluarga Tanoto dan Tanjung Enim Lestari (TEL) yang mengibarkan bendera APRIL (Asia Pacific Resources International Holding Ltd). Kedua kelompok ini memilih Singapura sebagai kantor pusat perusahaan mereka.

Pentingnya jaringan pemasaran lebih dipicu terutama pada pasar bebas di kawasan Asia Tenggara (AFTA) tahun 2003, dan kawasan Asia Pasifik (APEC) tahun 2010 yang lalu. Pasar bebas tersebut akan memaksa para produsen pulp dan kertas Indonesia untuk mampu bersaing memperebutkan pasar Asia Pasifik yang terbuka. Kawasan Asia Pasifik merupakan kawasan dengan pasar pulp terbesar di dunia. Oleh karena itu, perlu dilakukan analisis mengenai kondisi pasar luar negeri terutama pasar Asia, dan bagaimana strategi untuk memasuki dan mengembangkan pasar di kawasan tersebut. Selain itu pasar dalam negeri juga perlu dikaji karena merupakan basis untuk memperkuat daya saing secara nasional.

Saat ini, Indonesia berpotensi untuk menjadi produsen 3 besar dalam industri pulp dan kertas di dunia, antara lain karena produksi pulp dan kertas di tanah air diuntungkan oleh berbagai kondisi alam dan geografis di khatulistiwa ini. Saat ini Indonesia menempati peringkat 11 dunia untuk industri kertas dan peringkat 9 dunia untuk industri pulp.

Indonesia diuntungkan karena letak geografis Indonesia yang berada di garis khatulistiwa yang rata-rata memiliki pepohonan yang tumbuh tiga kali lebih cepat dibandingkan di negara-negara yang berada di daerah dingin, sehingga tersedia hutan yang luas sebagai sumber bahan baku, selain itu Indonesia juga berada di tengah-tengah Asia yang sedang berkembang menjadi raksasa ekonomi baru yang menjadi pasar terbesar pulp dan kertas dunia dimasa depan.

Persaingan global dalam bisnis pulp dan kertas sangat tinggi dan persyaratan lingkungan yang diterapkan juga semakin lama semakin ketat. Apalagi program hemat energi dan ramah lingkungan sekarang ini telah menjadi tuntutan bisnis, karena negara-negara tujuan ekspor dan para pembeli produk semakin menuntut adanya pulp dan kertas yang diproduksi dari sumber yang legal, yang dilengkapi dengan sertifikasi resmi mengenai legalitasnya.

Tahun 2013 saja, ekspor kertas dari Indonesia masih akan diwarnai dengan tuduhan dumping, karena harga kertas Indonesia sangat kompetitif di beberapa negara tujuan ekspor. Setiap tahun selalu ada negara tujuan ekspor kertas Indonesia yang melakukan tuduhan dumping. Industri kertas dan pemerintah terus melakukan perlawanan, antara lain melalui lembaga internasional seperti WTO.

Perlawanan juga dilakukan langsung terhadap negara-negara penuduh, karena apabila negara tujuan ekspor berhasil mengenakan Bea Masuk Anti Dumping (BMAD) terhadap suatu jenis kertas, dikhawatirkan tuduhan dumping akan berkembang kepada jenis-jenis kertas dan komoditi ekspor Indonesia lainnya.

Indonesia telah menjadi bulan-bulanan tuduhan dumping dari negara-negara tujuan ekspor kertas. Meskipun sebagian besar tuduhan tersebut dapat dipatahkan, tetapi untuk menghadapi tuduhan tersebut memakan waktu, tenaga, dan biaya. Industri kertas Indonesia juga harus menghadapi pengenaan Bea Masuk Anti Dumping (BMAD) dan Countervailing Duty (CVD), dimana negara-negara pesaing tidak mau mencabutnya, seperti yang terjadi terhadap ekspor kertas tulis-cetak ke Korea Selatan dan kertas koran ke Malaysia. Kedua negara tersebut tetap mengenakan BMAD meskipun sudah melewati batas waktu 5 tahun yang ditetapkan WTO.

Baru-baru ini, APKI meminta dukungan Kementerian Perdagangan dan Perindustrian agar mencermati banyaknya perjanjian perdagangan antara negara di dunia seperti PTA (Preferential Trade Agreement) dan FTA (Free Trade Agreement), apakah berpotensi memberikan dampak negatif atau positif terhadap neraca perdagangan Indonesia.

Misalnya PTA Pakistan-China, ternyata Pakistan memberikan penurunan bea-masuk terhadap kertas dari China. Tetapi karena belum ada PTA Pakistan - Indonesia, kertas Indonesia ke Pakistan tetap dikenakan bea-masuk normal. Nilai ekspor kertas Indonesia ke Pakistan dalam beberapa tahun ini sekitar USD55 juta/tahun. Sementara itu dengan PTA Pakistan-China, Pakistan mengenakan bea-masuk terhadap kertas packaging China sebesar 17%, sedang untuk kertas packaging ex. Indonesia dikenakan bea masuk normal sebesar 40%. Dengan ditandatanganinya PTA Pakistan-China dapat diperkirakan pembeli kertas Pakistan akan lebih memilih mengimpor kertas dari China, dibandingkan dari Indonesia.

-----------------------------------------------------------------------

DAFTAR ISI

BAB I PENDAHULUAN............................................................................... 1

1.1. Latar Belakang.......................................................................... 1

1.2. Tujuan dan Ruang Lingkup....................................................... 5

1.3. Sumber Data dan Informasi...................................................... 6

1.4. Struktur Industri Pulp dan Kertas............................................. 6

1.5. Pemain utama Industri Pulp dan Kertas.................................. 10

1.6. Aspek Produksi....................................................................... 12

BAB II PERTUMBUHAN PEREKONOMIAN DAN PENDUDUK

INDONESIA...................................................................................... 18

2.1. Pertumbuhan Ekonomi Indonesia Triwulan III-2012............. 20

2.1.1. Pertumbuhan Ekonomi Triwulan III-2012................ 22

2.1.2. Nilai PDB atas Dasar Harga Berlaku dan Harga

Konstan 2000 Triwulan III-2012.............................. 24

2.1.3. Struktur PDB menurut Lapangan Usaha

Triwulan III Tahun 2011 dan 2012........................... 26

2.1.4. PDB menurut Pengeluaran Triwulan III-2012.......... 27

2.1.5. Profil Spasial Ekonomi Indonesia menurut

Kelompok Provinsi, Triwulan III-2012..................... 31

2.2. Pertumbuhan Ekonomi Indonesia Triwulan IV-2012............. 32

2.2.1. Pertumbuhan Ekonomi Tahun 2012.......................... 33

2.2.2. Pertumbuhan Ekonomi Triwulan IV-2012................ 34

2.2.3. Struktur PDB menurut lapangan usaha,

Tahun 2010-2012...................................................... 36

2.2.4. PDB menurut Penggunaan........................................ 37

2.2.5. PDB dan Produk Nasional Bruto Per Kapita............ 40

2.2.6. Profil Spasial Ekonomi Indonesia menurut

Kelompok Provinsi Triwulan IV-2012...................... 41

2.3. Pertumbuhan Ekonomi Indonesia Triwulan I-2013

tumbuh 6,3-6,8 Persen............................................................. 42

2.4. Perkembangan indeks harga konsumen/inflasi........................ 44

2.5. Penduduk Indonesia bisa mencapai lebih dari 257 Juta

Jiwa Tahun 2013 .. 56

BAB III PULP DAN KERTAS ASAL HUTAN INDONESIA.................. 59

3.1...... Sejarah Pengelolaan Hutan di Indonesia................................. 59

3.2...... Fungsi Hutan........................................................................... 75

3.3...... Kerusakan Hutan Indonesia.................................................... 76

3.3.1. ... Ekspansi Industri Pulp dan Kertas besar-besaran..... 76

3.3.2..... 4 Jagoan Pulp dan Kertas.......................................... 78

3.3.3..... Menelusuri jejak rusaknya Hutan Indonesia............. 79

3.4. .... Industri Kehutanan membutuhkan momentum investasi........ 80

3.5...... Perkembangan pengelolaan hutan di Indonesia...................... 81

3.6...... Pemanfaatan hutan alam terbesar di Kalimantan.................... 82

3.6.1..... Kalimantan Timur memiliki hutan tanaman

............. Terbesar..................................................................... 83

3.7...... BUMN dominasi IUPHHK hutan alam.................................. 84

3.8...... Perusahaan chip mills memberikan tekanan lebih pada

........... hutan-hutan dan kehidupan di Kalimantan Selatan................ 85

3.8.1..... Kesenjangan pasokan................................................ 86

3.8.2..... Mengganti hutan dengan chip kayu.......................... 88

3.8.3..... Gambaran satu sisi saja untuk masyarakat desa-

............. desa di Pulau Laut..................................................... 91

3.8.4..... Dukungan Internasional............................................ 93

3.9...... Jumlah Perusahaan Hak Pengusahaan Hutan menurut

........... Provinsi.................................................................................... 94

3.10.... Luas areal perusahaan Hak Pengusahaan Hutan..................... 95

3.11.... Produksi Kayu Bulat oleh Perusahaan Hak Pengusahaan

........... Hutan menurut Jenis Kayu...................................................... 95

3.12.... Sebaran Hutan Tanaman Industri (HTI) di Indonesia............. 96

3.13.... Standar Nasional Indonesia (SNI) tentang Hasil Hutan......... 96

BAB IV TEORI TENTANG INDUSTRI PULP DAN KERTAS............ 105

4.1...... Pengertian Kertas.................................................................. 105

4.1.1..... Sejarah Kertas......................................................... 105

4.1.2..... Nicholas Louis Robert, penemu proses

............. pembuatan kertas..................................................... 106

4.1.3..... Ukuran kertas.......................................................... 107

4.1.4..... Kertas Washi........................................................... 116

4.1.5..... Kertas Daluwang..................................................... 125

4.1.6..... Kertas Lontar.......................................................... 129

4.2...... Ruang Lingkup Industri Pulp dan Kertas............................. 132

4.2.1..... Cakupan industri pulp............................................. 132

4.2.2. ... Cakupan industri kertas........................................... 132

4.3. .... Pengelompokan Industri Kertas............................................ 133

4.3.1. ... Kelompok Industri Hulu......................................... 133

4.3.2. ... Kelompok Industri Antara...................................... 133

4.3.3. ... Kelompok Industri Hilir.......................................... 133

4.3.4..... KBLI Produk Industri Pulp dan Kertas.................. 135

4.4. .... Standarisasi Industri Pulp dan Kertas................................... 135

BAB V BAHAN BAKU DAN PROSES PEMBUATAN PULP

DAN KERTAS................................................................................ 137

5.1...... Bahan Baku........................................................................... 137

5.1.1..... Selulosa................................................................... 137

5.1.2..... Jenis-jenis kertas...................................................... 138

5.2...... Proses Pembuatan Pulp dan Kertas....................................... 138

5.2.1..... Proses Pembuatan Bubur Kertas (Pulp).................. 138

5.2.2..... Proses Pembuatan Kertas (Paper machine)............ 142

5.2.3..... Beberapa fakta untuk menghargai selembar

............. Kertas...................................................................... 144

5.2.4. ... Pembuatan kertas basah-kering............................... 146

5.2.5. ... Pengeringan dalam mesin Fourdrinier..................... 146

5.2.6..... Aspek ekonomis...................................................... 147

BAB VI KONDISI PASAR INDUSTRI PULP dan KERTAS

DI INDONESIA.............................................................................. 150

6.1. .... Indonesia berpeluang menyusul Skandinavia di Pasar

........... Bubur Kertas......................................................................... 150

6.2...... Pasar Kertas Domestik tumbuh 4,2% tahun ini..................... 153

6.3...... Sinarmas bangun Pabrik Kertas 27 Triliun Rupiah................ 154

6.4...... Menteri Perindustrian pelajari boikot kertas oleh

........... Walt Disney........................................................................... 156

6.5...... Industri Percetakan tumbuh Negatif..................................... 157

6.6...... Harga Kertas dan Bubur Kertas merosot.............................. 158

6.7...... Peluang Indonesia menjadi pemasok utama Pulp

........... dan Kertas............................................................................. 159

6.8...... Produksi Kertas bisa mencapai 13 Juta Ton.......................... 160

6.9...... Indonesia menuju Net Importer Kertas................................. 161

6.10.... Pulp dan Kertas perlu adopsi Teknologi Hijau...................... 162

6.11.... Produsen Kertas harus ikuti Prosedur WTO......................... 163

6.12.... Produksi Pulp naik 5,26 Persen............................................. 165

6.13.... Momentum kebangkitan Industri Pulp dan Kertas Indonesia 165

6.14.... KADI Investigasi Impor Kertas............................................ 167

6.15.... Produksi kertas nasional dalam prosesnya mengacu

........... kepada Syarat Verifikasi Legalitas Kayu (SVLK)................ 169

6.16.... Taiwan membuat kertas dari beras dan batang gandum........ 170

6.17.... Industri Pulp butuh 1,5 Juta Hektar...................................... 171

6.18.... Permintaan naik, APP memacu produksinya......................... 172

6.19.... Eco-Labeling dan Otonomi Daerah....................................... 174

6.19.1... Pengertian dari ECO-LABELING......................... 175

6.19.2... Sejarah Perkembangan Ekolabel............................. 176

6.19.3... Permasalahan dengan Pengembangan

............. Agribisnis Pulp dan Kertas dalam Era Eco-

............. Labeling dan Otonomi Daerah................................ 179

6.19.4... Hasil Analisa Eco-Labeling pada Industri

............. Pulp dan Kertas....................................................... 181

6.20.... Pembangunan Industri Pulp dan Kertas: Jangan

........... mengganggu Kelestarian Hutan Alam Indonesia.................. 181

6.20.1... Ekspor dan konsumsi Pulp dan Kertas

............. Indonesia semakin meningkat................................. 182

6.20.2... Bahan baku Pulp dan Kertas dari hutan alam

............. Indonesia................................................................. 183

6.20.3... Realisasi pembangunan Hutan Tanaman

............. Industri (HTI) terlalu lambat................................... 184

6.20.4... Semakin merusak hutan alam.................................. 185

6.20.5... Jalan Keluar............................................................. 186

6.21.... Tiga unit usaha APP meraih penghargaan Industri

........... Hijau 2012............................................................................. 187

6.22.... Menteri Perindustrian menyikapi boikot Kertas

........... oleh Walt Disney................................................................... 187

6.23.... Sinarmas membangun Pabrik Kertas Rp 27 Triliun............... 188

6.24.... Indonesia menuju Net Importer Kertas................................. 189

6.25.... Pembangunan Pabrik Kertas terbesar di Asia........................ 190

6.26.... Industri Pulp membutuhkan tambahan 1,5 Juta Hektar........ 192

6.27.... Produsen kertas harus mengikuti prosedur WTO.................. 193

6.28.... Ekspor Pulp dan Kertas ditargetkan naik US$2,64 Miliar.... 194

6.29.... Industri Pulp dan Kertas menarik Investasi US$ 16 miliar... 196

6.30.... Sebagian Pengusaha Pulp dan Kertas keluhkan

........... minimnya pasokan bahan baku kayu..................................... 197

6.31.... Pasar dunia mengandalkan kayu asal Indonesia.................... 198

6.32.... Ekspor pulp dan kertas diprediksi tumbuh 4%...................... 200

6.33.... Luas Hutan Tanaman Industri (HTI) turun, Hutan

........... Rakyat naik............................................................................ 202

6.33.1... Nilai Investasi pada Industri Kehutanan

............. naik 10%.................................................................. 203

6.33.2... Kehutanan: SVLK tidak menghambat kinerja

............. ekspor kayu Indonesia............................................. 204

6.34.... Industri Indonesia diprediksi tidak akan mampu

........... menggarap peluang Pulp dan Kertas di Asia......................... 206

6.35.... Target Produksi RAPP bakal stagnan 2,8 juta ton................ 207

6.36.... Investasi Industri Kertas diharapkan naik 8%................. 208

6.37.... Pulp dan Kertas, komoditi ekspor non migas andalan

........... Indonesia.............................................................................. 209

6.38.... Pembangunan Pabrik Kertas “OKI Pulp dan Paper Mills”,

........... terbesar di Asia..................................................................... 211

6.39.... Industri Kertas dan Bubur Kertas Genjot Produksi.............. 213

6.40.... Industri kertas diharapkan meningkat 8 persen

........... tahun 2013............................................................................. 215

6.41.... Pengusaha Pulp dan Paper meminta kepada Pemerintah,

........... agar Peraturan Verifikasi Legalitas Kayu diperjelas.............. 216

6.43.... Pengusaha Pulp dan Kertas, mengeluhkan minimnya

........... pasokan bahan baku Kayu..................................................... 220

6.44.... Diterpa isu miring, ekspor kertas bangkit............................. 222

6.45.... Isu Lingkungan NGO Internasional Lemahkan Ekspor

........... Kertas.................................................................................... 223

6.46.... Permintaan naik, APP menggenjot produksinya................... 224

6.47.... Perusahaan Taiwan membuat kertas dari beras dan

........... batang gandum...................................................................... 226

6.48.... Momentum kebangkitan Industri Pulp dan Kertas

........... Indonesia............................................................................... 227

6.49.... Produksi Kertas bisa mencapai 13 Juta Ton.......................... 229

6.50.... Pabrik Kertas milik Prabowo terbesar di ASEAN................ 230

6.51.... Industri Tembakau (Rokok).................................................. 243

6.51.1... Perkembangan Nilai Ekspor Tembakau................... 243

6.51.2... Trend Nilai Ekspor Tembakau................................. 243

6.51.3... Perkembangan Volume Ekspor Tembakau.............. 243

6.51.4... Trend Volume Ekspor Tembakau............................ 243

6.51.5... Perkembangan Nilai Impor Tembakau.................... 244

6.51.6... Trend Nilai Impor Tembakau.................................. 244

6.51.7... Perkembangan Volume Impor Tembakau............... 244

6.51.8... Perkembangan jumlah tenaga kerja pada

............. Industri Tembakau dan Rokok................................ 244

6.51.9... Trend jumlah tenaga kerja pada Industri

............. Tembakau dan Rokok............................................. 244

6.51.10. Perkembangan Nilai Ekspor Rokok menurut

............. Negara Tujuan......................................................... 245

6.51.11. Perkembangan Nilai Impor Industri Rokok

............. menurut Negara Asal............................................... 246

6.52.... Industri Kemasan Karton...................................................... 247

6.52.1... Anthoni Salim Gandeng Jepang Operasikan

............. Pabrik Kemasan Karton.......................................... 251

6.52.2... Melihat bisnis kemasan sebagai peluang

............. usaha menguntungkan............................................. 252

6.53.... Daftar Perusahaan Industri Pulp dan Kertas, Kapasitas

........... Terpasang dan Jenis Produk.................................................. 257

BAB VII... PROSPEK DAN TANTANGAN INDUSTRI PULP

.................. DAN KERTAS INDONESIA..................................................... 265

7.1... Industri Kertas Indonesia masih prospektif.......................... 265

7.2. . Kecenderungan Global.......................................................... 266

7.2.1. ... Kecenderungan yang telah terjadi........................... 266

7.2.2. ... Kecenderungan yang akan terjadi........................... 267

7.2.3. ... Analisis terhadap kecenderungan yang

............. telah dan akan terjadi dalam perkembangan

............. Industri Kertas........................................................ 270

7.3. . Permasalahan yang dihadapi Industri Kertas........................ 271

7.4... Faktor Daya Saing................................................................. 273

7.4.1. ... Permintaan dan Penawaran..................................... 273

7.4.2. ... Faktor Kondisi (Input)............................................ 275

7.4.2.1. Sumber Daya Alam................................... 275

7.4.2.2. Sumber Daya Modal................................. 277

7.4.2.3. Sumber Daya Manusia.............................. 278

7.4.2.4. Infrastruktur.............................................. 278

7.4.2.5. Teknologi.................................................. 279

7.5. . Industri Inti, Pendukung dan Terkait.................................... 280

7.6. . Strategi Pengusaha dan Perusahaan...................................... 280

7.7. . Analisis SWOT...................................................................... 281

7.7.1. ... Kekuatan................................................................. 281

7.7.2. ... Kelemahan............................................................... 281

7.7.3. ... Peluang.................................................................... 281

7.7.4. ... Ancaman................................................................. 282

7.8. . Sasaran................................................................................... 282

7.8.1. ... Jangka Menengah (2010-2014)............................... 282

7.8.2. ... Jangka Panjang (2010-2025)................................... 283

7.9. . Strategi dan Kebijakan.......................................................... 283

7.9.1. ... Visi dan arah pengembangan Industri Kertas......... 283

7.9.2. ... Indikator Pencapaian............................................... 284

7.9.3. ... Tahapan Implementasi............................................. 284

7.10. Program................................................................................. 286

7.10.1... Jangka Menengah (2010-2014)............................... 286

7.10.2... Jangka Panjang (2010-2025)................................... 286

7.11. Kelembagaan..................................................................291

7.12. Daftar Perusahaan/Produsen Board Industrial...................... 291

7.13. Daftar Perusahaan/Produsen Cigarette Paper........................ 294

7.14. Daftar Perusahaan/Produsen Corrugating Medium............... 294

7.15. Daftar Perusahaan Produsen Joss Paper................................ 296

7.16. Daftar Perusahaan Produsen Kraft Liner and Fluting........... 297

7.17. Daftar Perusahaan/Produsen Newsprint................................ 299

7.18. Daftar Perusahaan/Produsen Printing/Writing Uncoated...... 300

7.19. Daftar Perusahaan/Produsen Printing/Writing Coated.......... 301

7.20. Daftar Perusahaan Produsen Sack Kraft (Kertas Semen)..... 302

7.21. Daftar Perusahaan Produsen Security Paper......................... 302

7.22. Daftar Perusahaan Produsen Specialty Paper........................ 303

BAB VIII. PERKEMBANGAN EKSPOR-IMPOR DAN KINERJA

.................. INDUSTRI PULP dan KERTAS............................................... 304

8.1. . Pulp........................................................................................ 304

8.2. . Kertas.................................................................................... 304

8.2.1. ... Kertas Budaya......................................................... 304

8.2.2. ... Kertas Industri........................................................ 305

8.2.3. ... Kertas Tissue........................................................... 306

8.3. . Realisasi Produksi.................................................................. 306

8.3.1. ... Pulp......................................................................... 306

8.3.2. ... Kertas...................................................................... 307

8.4... Indeks Kinerja Industri Pulp dan Kertas............................... 308

8.5... Pemantauan Impor Sub Kelompok Hasil Industri

........ Kertas Budaya...................................................................... 311

8.6... Pemantauan Impor Sub Kelompok Hasil Industri

........ Barang dari kertas/karton lainnya.......................................... 313

8.7... Perkembangan Ekspor Komoditi pulp Hasil Industri

........ Ke Negara............................................................................ 315

8.8... Perkembangan Impor Komoditi Pulp Hasil Industri

........ dari Negara........................................................................... 319

8.9... Perkembangan Ekspor Komoditi paper Hasil Industri

........ Ke Negara............................................................................ 323

8.10. Perkembangan Impor Komoditi paper Hasil Industri

........ dari Negara........................................................................... 335

8.11. Perusahaan Eksportir Pulp Indonesia.................................... 348

8.12. Perusahaan Eksportir Kertas Indonesia................................. 351

8.13. Pemantauan Impor 31 Kelompok Hasil Industri................... 377

8.14. Perkembangan Nilai Produksi Industri Besar dan

........ Sedang Indonesia................................................................. 379

8.15. Realisasi Ekspor Pulp dan Kertas ke Amerika Serikat

........ (Juta US$).............................................................................. 404

BAB IX.... REALISASI INVESTASI PADA INDUSTRI

.................. PULP dan KERTAS.................................................................... 405

9.1... Investasi Industri Kertas ditaksir tumbuh 8%....................... 405

9.2... Perkembangan Realisasi Investasi PMA berdasarkan

........ Laporan Kegiatan Penanaman Modal (LKPM)

........ menurut Sektor Triwulan IV 2012........................................ 409

9.3... Perkembangan Realisasi Investasi PMA berdasarkan

........ Laporan Kegiatan Penanaman Modal (LKPM)

........ menurut Lokasi Triwulan IV 2012........................................ 412

9.4... Perkembangan Realisasi Investasi Pma Berdasarkan

........ Laporan Kegiatan Penanaman Modal (LKPM)

........ menurut Negara Triwulan IV 2012....................................... 416

9.5... Perkembangan Realisasi Investasi PMDN berdasarkan

........ Laporan Kegiatan Penanaman Modal (LKPM)

........ menurut Sektor Triwulan IV 2012........................................ 423

9.6... Perkembangan Realisasi Investasi PMDN berdasarkan

........ Laporan Kegiatan Penanaman Modal (LKPM)

........ menurut lokasi Triwulan IV 2012.......................................... 427

BAB X ..... ERA ECO-LABELING DAN OTONOMI DAERAH............. 431

10.1. Pengertian dari Eco-Labeling................................................ 431

10.2. Sejarah Perkembangan Ekolabel............................................ 432

10.3. Permasalahan dengan Pengembangan Agribisnis Pulp dan

........ Kertas dalam Era Eco-Labeling dan Otonomi Daerah.......... 435

10.4. Produsen Pabrik Pulp dan Kertas Indonesia yang

........ telah menerapkan Ekolabel.................................................... 437

BAB XI.... PERKEMBANGAN INDUSTRI PULP DAN

.................. KERTAS DUNIA......................................................................... 439

11.1. Peluang Bisnis (Sektor Kertas dan Pulp di India)................. 453

11.1.1... Pasar berkembang untuk Kertas.............................. 453

11.1.2... Fokus....................................................................... 453

11.1.3... Faktor dibalik pertumbuhan.................................... 454

11.1.4... Ikhtisar Industri....................................................... 455

11.2. Outlook sektor Pulp dan Kertas Kanada, 2011-2020........... 457

11.3. Industri Pulp dan Kertas Brazil............................................. 476

11.4. Industri Pulp dan Kertas di China......................................... 489

BAB XII... KEBIJAKAN PEMERINTAH PADA INDUSTRI

.................. PULP DAN KERTAS.................................................................. 491

12.1. Green Industry: Pemerintah Dorong Penerapan

........ Industri Hijau untuk Pulp dan Kertas................................... 491

12.2. SK Menteri Kehutanan Republik Indonesia

........ No. SK.101/Menhut-II/2004 tentang Percepatan

........ Pembangunan Hutan Tanaman untuk Pemenuhan

........ Bahan Baku Industri Pulp dan Kertas................................... 492

12.3. Rencana Strategis Balai Besar Pulp dan Kertas

........ Tahun 2010-2014................................................................... 501

BAB XIII. POTENSI KONSERVASI ENERGI DAN REDUKSI

.................. EMISI PADA BEBERAPA PRODUSEN INDUSTRI

.................. PULP dan KERTAS.................................................................... 509

13.1. Peluang Penghematan Energi pada Industri Pulp

........ dan Kertas............................................................................. 509

13.2. Potensi Konsumsi Energi dan Reduksi Emisi pada

........ Industri Pulp.......................................................................... 513

13.2.1... Tanjung Enim Lestari.............................................. 516

13.2.2... Toba Pulp Lestari.................................................... 518

13.3. Potensi Konservasi Energi dan Reduksi Emisi

........ di Industri Kertas.................................................................. 521

13.3.1... Adiprima Suraprinta................................................ 523

13.3.2... Aspec Kumbong...................................................... 526

13.3.3... Bekasi Teguh........................................................... 529

13.3.4... Fajar Surya Wisesa.................................................. 532

13.3.5... Indah Kiat – Serang................................................ 535

13.3.6... Pakerin..................................................................... 538

13.3.7... Pindo Deli............................................................... 540

13.3.8... Pura Nusa Persada................................................... 542

13.3.9... Pura Barutama......................................................... 545

13.3.9... Surya Zigzag........................................................... 548

13.4. Potensi Konservasi Energi dan Reduksi Emisi di

........ Industri Pulp dan Kertas Terpadu......................................... 551

13.4.1... Indah Kiat Perawang Pulp and Paper..................... 553

13.4.2... Lontar Papyrus........................................................ 555

13.4.3... Riau Andalan Pulp and Paper................................. 557

BAB XIV. PENELITIAN DAN PENGEMBANGAN TEKNOLOGI

.................. PULP, KERTAS, DERIVAT SELULOSA DAN

.................. LINGKUNGAN............................................................................ 558

14.1. Bidang Sarana Riset dan Standardisasi................................. 558

14.2. Penelitian............................................................................... 563

BAB XV LIMBAH INDUSTRI PULP DAN KERTAS........................... 568

15.1. Aturan Limbah Industri: Undang-Undang Nomor

........ 32/2009 tentang Perlindungan dan Pengelolaan

........ Lingkungan Hidup................................................................ 568

15.2. Dunia Usaha keberatan RPP Limbah B3.............................. 569

15.3. Asia Pulp dan Paper mempunyai Teknologi Penyaring

........ Air Bersih IPAG60................................................................ 571

15.4. Pemanfaatan campuran limbah padat dengan lindi

........ hitam sebagai bahan Bio Briket............................................. 571

15.5. Konsep Zero Waste.............................................................. 580

BAB XVI PENGGUNAAN BAHAN BAKU INDUSTRI PULP DAN

KERTAS PADA PERUSAHAAN SKALA BESAR.............. 585

16.1. Fokus perhatian Dunia pada HTI Indonesia........................ 587

16.2. Kawasan Hutan dan Pemanfaatannya................................. 590

16.2.1. Luas Kawasan Hutan Indonesia............................ 592

16.2.2. Trend Perkembangan Pembangunan IUPHHK-

Hutan Alam dan Hutan Tanaman.......................... 593

16.3. Industri Pulp dan Kebutuhan Bahan Baku.......................... 597

16.3.1. . Kebutuhan Bahan Baku untuk Industri Pulp

............. RAPP dan IKPP.................................................... 598

16.3.2. . Membandingkan kontribusi HTI dan Hutan

............. Alam bagi PT. RAPP dan PT. IKPP...................... 609

16.4. Pemenuhan Bahan Baku, dan Kondisi Hutan

........ Alam Riau............................................................................ 618

BAB XVII PENUTUP................................................................................... 622

17.1. Kesimpulan........................................................................... 622

17.2. Implikasi Kebijakan.............................................................. 623

17.3. Prospek 5 tahun ke depan.................................................... 624

RUJUKAN REGULASI

------------------------------------------------------

SAMPLE: COMPANY PROFILE

Company

|

:

|

PT. ASIA CARTON LESTARI, Integrated Sister company of

PT. PAKERIN (PABRIK KERTAS INDONESIA) in Surabaya.

|

Date of establishment

|

:

|

16th December 1996

|

Address

|

:

|

Jl. Kasir II No. 7, Kelurahan Pasir Jaya

Kecamatan Jatiuwung

TANGERANG 15135

|

Phone

|

:

|

++ 62 - 21 5903362 (Hunting)

|

F a x

|

:

|

++ 62 - 21 5903363, 5905508

|

N P W P

|

:

|

1.679.499.2-402

|

Type of Product

|

:

|

Corrugated Carton Box, Capacity 3500 Tons/month

Paper Tube / Bobbin, Capacity 1500 Tons/month

|

No. of employee

|

:

|

550 people

|

Total Investment

|

:

|

US$. 10,000,000.00

|

Land area

|

:

|

39,625 m²

|

Board of Director

|

:

|

David S. Kurniawan

|

Person in charge

|

:

|

Hengky Somali - General Manager

M. Anwar - Vice Sales Manager

N. A. Hamdani - Accounting Manager

Ma' Ani - Technical Manager

Lie Jiauw Tek - PPIC Manager

Endang S. - Production Manager for Corrugated Carton Box

Taufik - Production Manager for Paper Tube

|

Installed machineries

|

:

|

|

No.

|

TYPE OF MACHINE

|

MAKER

|

SPECIFICATION

|

QTY.

|

1

|

Corrugating Machine

|

Hsieh Hsu

|

Width : 1800 mm

|

1

|

2

|

Flexo Printer Slotter

|

Ming Wei

|

2 Color

|

1

|

3

|

Flexo Printer Slotter

|

Hsieh Hsu

|

2 Color

|

1

|

4

|

Flexo Printer Slotter

|

TCY

|

3 Color

|

1

|

5

|

Long Way Printing machine

|

Hsieh Hsu

|

2 Color

|

1

|

6

|

Pounch

|

|

|

6

|

7

|

Rotary Die Cut

|

Ming Wei

|

Width : 1600 mm

|

1

|

8

|

Glue Machine

|

|

|

1

|

9

|

Stitching Machine

|

|

|

20

|

10

|

Strapping Machine

|

|

|

15

|

11

|

Tying Machine

|

|

|

10

|

12

|

Paper Slitting Machine

|

|

|

4

|

13

|

Paper Tube Winding Machine

|

|

|

10

|

THE FACTORY

PT. ASIA CARTON LESTARI located in the industrial area in Pasar Kemis, Jl. Kasir II No. 7, TANGERANG, on the land about 4 Ha. The location is very strategic for the access towards Tangerang city, Highway Gate Bitung / Curug as well as to the international Airport Sukarno-Hatta Cengkareng.

Presently PT. ASIA CARTON LESTARI employs about 550 employee, which devided into 2 shift operation. With the support from PAKERIN's group for the supply of paper as raw material as well as the support through its experiences PT. ASIA CARTON LESTARI has grown to be a reliable partner for its customers to supply their demand for the corrugated carton boxes and paper tubes.

MACHINERY

Corrugated Carton Board / sheet machine with high speed and capacity produces high quality of corrugated carton sheets. Using a corrugating machine with 1800 mm paper width and installed speed about 150 m/min PT. ASIA CARTON LESTARI is able to achieve production capacity of over 3500 Tons per month.

Our 2 and 3 color automatic Flexo Printer Slotter machines can print 2 - 3 color instantaneously with high quality and precision. Additionally the high precision automatic Gluing Machine assures the high quality and reliable product.

AUTOMATIC GLUING MACHINE

In the other side, the Paper Tube Division of PT. ASIA CARTON LESTARI uses 4 units Slitting machines and 10 units Winders. Supported by long term working experience the Paper Tube Division is able to achieve the production capacity of about 1500 Tons high quality Paper Tube per month with various sizes of Tube and quality upon the customer's request.

QUALITY

PT. ASIA CARTON LESTARI is fully supported by PT. PAKERIN, which builds a fully integrated Corrugated Carton Box and Paper Tube company with a paper manufacturing company, therefore we have significant advantages, i.e. :

1. Stable quality and assurance of paper supply as raw material, which supported by paper manufacturing company as integrated Headquarters.

2. If any problems occur with the paper, the problem can be solved immediately due to the factory integration.

On the other hand, with our laboratory equipment and the experts in its field we are always controlling the quality of our finished products in order to assure our customer's satisfaction. Testing in our laboratory starts from the raw material test up to the finished goods test.

|

The following tests can be performed at PT. ASIA CARTON LESTARI's QC-Lab :

|

1. Box Compression Test (BCT)

2. Bursting Test

3. Edgewise Crush Test (ECT)

4. Flat Crush Test (FCT)

5. Pin Adhesion Test (PAT)

6. Moisture Test

7. Etc.

|

|

OUR COMMITMENT

To serve our customers with high quality of product and on time delivery to assure our customer's satisfaction.

PRODUCTS

Corrugated Carton Box

PT. ASIA CARTON LESTARI manufactures high Quality of Corrugated Carton Boxes, for the Box Quality as well as the Printing; therefore we are able to serve our Customer's requirement and our Customer's Satisfaction.

PT. ASIA CARTON LESTARI manufactures various kind of Corrugated Carton Boxes with various Quality Grades and Sizes to suit the Customer's requirement. Our Product Ranges consist of :

From the simple Standard Boxes

Up to the Complicated Chicken Boxes

The following table will give you the Information about the Paper Grade and Weight, which are commonly used in PT. ASIA CARTON LESTARI.

No.

|

TYPE OF PAPER

|

WEIGHT

|

1.

|

KRAFT LINER (KL)

|

125 gsm, 150 gsm, 200 gsm and 300 gsm

|

2.

|

MEDIUM LINER (ML)

|

125 gsm, 150 gsm, 250 gsm

|

3.

|

WHITE LINER (WL)

|

150 gsm, 200 gsm

|

NEW PRODUCT

PAPER PALLET

For our concern to the surrounding Nature we introduce herewith our New Product, i.e. the Paper Pallet in order to replace the wooden Pallet.

ADVANTAGES

• Termites Free

• Bark Free

• Environmental Friendly

• Fully Recyclable

• Light Weight

Paper Tubes

PT. ASIA CARTON LESTARI manufactures Paper Tubes with various Sizes and Tube Thickness in order to suit the Customer's requirements. The Diameter, which can be manufactured in PT. ASIA CARTON LESTARI, is from the smallest 13 mm up to 375 mm, and the Tube Thickness can be fom 1 mm up to 15 mm.

Beside the Diameter and the Thickness of the Paper Tubes, PT. ASIA CARTON LESTARI manufactures various kind of Paper Tubes, from the simple standard type,

Up to the complicated type like BULL NOSE

------------------------------------------------------

FORMULIR PESANAN

ORDER FORM

Kirimkan kepada kami buku : “STUDI TENTANG KONDISI PASAR DAN PROSPEK INDUSTRI PULP DAN KERTAS DI INDONESIA”, 2013.

Send us the book : "STUDY ON THE MARKET CONDITIONS AND PROSPECTS OF PULP AND PAPER INDUSTRY IN INDONESIA”, 2013.

Silahkan pilih versi buku anda

Please select the version of your book

Versi/version : √ ( ) Indonesia atau/or ( ) English

Tanggal Pemesanan : ………………………………………………………………………………………………………

Booking date

Nama Pemesan : ………………………………………………………………………………………………………

Name of buyer

Jabatan : ………………………………………………………………………………………………………

Position

Nama Perusahaan : ………………………………………………………………………………………………………

Name of Company

Alamat Perusahaan : ………………………………………………………………………………………………………

Company Address

Telepon/Fax : ………………………………………………………………………………………………………

Phone/Fax

Email : ………………………………………………………………………………………………………

Hubungi kami / Contact Us :

DENI SILALAHI (Marketing Department) “Commercial Global Data Research”

Address : Sukamanah RT. 04/06 Cisaat, Sukabumi, West Java – INDONESIA

Phone : +62 (0266) 9296038, 085793929829; Fax: +62 (0266) 241346; E-mail: cg.dataresearch@gmail.com

Pembayaran melalui : √ Cash Cheque Transfer

Payment via

Nama Bank : BANK OCBC NISP

Bank name Cabang Sukabumi

Nomor Rekening : 14081015480-1

Account number

Rekening atas nama : ROHIYAH

Account in the name

Buku pesanan Anda akan segera kami kirim setelah ada konfirmasi dari pihak pemesan.

Book your order will immediately tell us when there is confirmation from the buyer

Terima kasih atas kepercayaan anda bermitra dengan kami.

Thank you for the trust you partner with us.

Hormat kami/sincerely

Signature,

DENI SILALAHI

Marketing

ENGLISH VERSION

Our customers love! Peace.

May we all exist in the shadow of God!

Background: Commercial Global Data Research (CDR)

We are an agency consultant, Survey, Research and Reporting in the areas of global research data, presenting a variety of real-time business information that includes the manufacturing industry sector, mining, banking, insurance, feasibility studies, and other research services.

We present as your consultant partner, to provide real-time information that you need in order to determine the direction of policy in developing your company. One study book products that we offer to you is "Book Study on the Market Conditions and Prospects of Pulp and Paper Industry in Indonesia, 2013.

We offer these books to you for Rp. 7,000,000 (seven million rupiahs), to help businesses in the Pulp and Paper Industry, helping the investors, help the banks or creditors, and other relevant parties, by looking at the map of power among the competitors / your partner, both competitors from abroad and within the country, studying the development of Export and Import products Pulp and Paper in Indonesia, knowing the obstacles and opportunities for companies whose condition fluctuates, find out the Main market of any company's Pulp and Paper, know the market share abroad, knowing the Board of Directors and Commissioners , as well as the other information you need to know. (Company Profile attached example).

How big is your company's contribution in increasing production capacity to meet orders from buyers both locally and internationally, look at all the opportunities that exist, and are expected to have this book, your company become more productive, efficient, more advanced and compete fairly.

------------------------------------------------------------

INTRODUCTION

Agro Industry has a strategic role in the Indonesian economy and industrial structure. It can be seen from the contribution of Agriculture in GDP, exports, and employment. Other role is in support of food security, support economic development and equitable distribution to the industry throughout Indonesia.

Industrial development had been showing progress, but not optimal, as expected. This is due to a variety of challenges and problems faced, among others:

1. Still based on comparative advantage;

2. Scarcity of raw materials, as widely exported in the form of primary products;

3. Increasing competition;

4. The existence of tariff and non-tariff barriers, thus still needed development efforts through various policies and programs that effectively.

Especially for the Pulp and Paper Industry in Indonesia, today is growing and developing rapidly in line with the increasing consumption of pulp and paper usage. The development of this industry will continue to increase and supported also by the existence of Indonesia which have a comparative advantage, such as the potential of forest to supply the wood as raw material. This potential will increase with the development program. Industrial Plantation Forest (HTI) which is now being promoted implementation. Similarly, the availability of non-wood fiber raw materials are relatively abundant.

Pulp and paper industry is also one industry which has an important role and is the flagship product in supporting the Indonesian economy. There are 3 main reasons behind the importance of the contribution of this industry, First: pulp and paper product prices are determined in the value of the dollar; Second: imported components used in the production process is worth no more than 30%, and Third: pulp and paper products tend to be much intended for the export market. So that in times of global economic crisis facing Indonesia at that time, the industry is still reliable in helping the acceptance of foreign exchange.

Importance of the pulp and paper industry is not large regardless of the condition they have. Until now the Indonesian pulp and paper industry has a comparative advantage compared to other countries. The advantages are more reliant on abundant sources of raw materials at a relatively cheap and labor with relatively low labor costs. In terms of raw materials, for example, Indonesia is the country's largest provider of pulp raw material, because it has the second largest forest in the world. So that the raw material (wood) for the manufacture of pulp and paper available lot in Indonesia. So also in the case of labor, productive labor force in Indonesia reaches tens of millions of people. The comparative advantage as a result of natural conditions and demographics. But comparative advantage has not been a sufficient condition to be able to compete in the future. To be able to compete with similar industries of other countries in the future, it should be increased comparative advantage into competitive advantage. This competitive advantage will be relying on the innovation of products, processes and services, the use of environmentally friendly technologies, market expansion, and benchmarking with internationally reputed companies.

Judging from the share of the production and export control networks overseas markets, is still a weakness for most of the Indonesian pulp and paper manufacturers. Even so, some (group) company has been trying to penetrate foreign markets, especially the Asian market, by expanding into countries in the region. Sinar group entered the Asian market by setting up a group of companies through flag APP (Asia Pulp and Paper) in Singapore, China, Malaysia, and India. So also with the family Tanoto and Tanjung Enim Lestari (TEL) is flying the flag APRIL (Asia Pacific Resources International Holdings Ltd). Both groups chose Singapore as their corporate headquarters.

The importance of network marketing is more driven primarily on the free market in Southeast Asia (AFTA) in 2003, and the Asia Pacific region (APEC) in 2010. The free market will force the Indonesian pulp and paper manufacturers to be able to compete for the Asia Pacific markets are open. Asia Pacific is the region with the world's largest pulp market. Therefore, it is necessary to analyze the condition of overseas markets, especially the Asian market, and how strategies to enter and develop the market in the region. Besides the domestic market also needs to be studied because it is the basis for strengthening national competitiveness.

Currently, Indonesia has the potential to be a top 3 manufacturers in the pulp and paper industry in the world, partly because of the production of pulp and paper in the country benefited by various natural and geographical conditions at the equator. Currently, Indonesia is ranked 11th for the paper industry and 9th world for the pulp industry.

Indonesia benefited from Indonesia's geographical location at the equator on average have trees that grow three times faster than in the countries that are in cold regions, making available vast forests as a source of raw materials, but it is also located in Indonesia the middle of the emerging Asian economic giant into new markets the world's largest pulp and paper in the future.

Global competition in the pulp and paper business is very high and environmental requirements applicable also becoming increasingly stringent. Moreover, energy-saving programs and environmentally friendly is today the demands of business, because the export destination countries and the buyers are increasingly demanding the pulp and paper produced from legal sources, which comes with an official certification regarding its legality.

In 2013 alone, exports of Indonesian paper will still tinged with allegations of dumping, because the price is very competitive Indonesian paper in some export destinations. Every year there is always a paper Indonesian export destination countries are doing the dumping charges. Paper industry and government continue to take the fight, including through international institutions such as the WTO.

Resistance also be made directly to the accuser states, since if successful export destination countries impose anti-dumping duty (BMAD) to a type of paper, it is feared dumping charges will evolve to the types of paper and other Indonesian export commodities.

Indonesia has become the butt of the alleged dumping of export destination countries of the paper. Although most of the charges can be dismissed, but to face the charges takes time, effort, and cost. Indonesian paper industry also has to face the imposition of anti-dumping duty (BMAD) and Countervailing Duty (CVD), in which the competing countries do not want to pull out, as happened to the printing-writing paper exports to South Korea to Malaysia and newsprint. Both countries are still wearing BMAD despite being over the limit of 5 years specified WTO.

Recently, APKI requested support from the Ministry of Trade and Industry in order to look at the many trade agreements between the countries in the world such as the PTA (Preferential Trade Agreement) and the FTA (Free Trade Agreement), whether the potential negative or positive impact on Indonesia's trade balance.

Pakistan-China PTA for example, it turns out Pakistan giving duty-log reduction on paper from China. But because there is no Pakistan PTA - Indonesian, Indonesian paper to Pakistan remains subject to import-enter normal. The export value of Indonesian paper to Pakistan in recent years, approximately $ 55 million / year. Meanwhile the Pakistan-China PTA, Pakistan-enter impose duties on Chinese paper packaging by 17%, while for the paper packaging ex. Indonesia normal duty levied at 40%. With the signing of the Pakistan-China PTA can be expected buyers would prefer a Pakistan paper paper imports from China, than from Indonesia.

-----------------------------------------------------------

TABLE OF CONTENTS

CHAPTER I INTRODUCTION 1

- Background 1

- Purpose and Scope 5

- Source of Data and Information 6

- Structure of the Pulp and Paper Industry 6

- The main players Pulp and Paper Industry 10

- Aspects of Production 12

CHAPTER II AND POPULATION GROWTH

INDONESIA 18

2.1. Indonesian Economic Growth Third Quarter 2012 20

2.1.1. Economic Growth in Third Quarter 2012 22

2.1.2. Value of GDP at Current Prices and Price

At constant 2000 Third Quarter 2012 24

2.1.3. Structure of GDP by Sectors

Third Quarter 2011 and 2012 26

2.1.4. GDP by Expenditure Third Quarter 2012 27

2.1.5. Indonesian Economic Spatial profiles according

Provincial Group, Third Quarter 2012 31

2.2. Economic growth in Indonesia in Quarter IV-2012 32

2.2.1. Economic Growth In 2012 33

2.2.2. Economic Growth in Fourth Quarter of 2012 34

2.2.3. Structure of GDP by economic activities,

Year 2010-2012 36

2.2.4. GDP by expenditure 37

2.2.5. GDP and Per Capita Gross National Product 40

2.2.6. Indonesian Economic Spatial profiles according

Provincial groups Quarter IV-2012 41

2.3. Indonesian Economic Growth First Quarter-2013

42 grew from 6.3 to 6.8 Percent

2.4. Development of the consumer price index / inflation 44

2.5. Indonesia's population could reach more than 257 million

Soul in 2013 56

CHAPTER III PULP AND PAPER FOREST INDONESIA ORIGIN 59

3.1. History of Forest Management in Indonesia 59

3.2. Forest functions 75

3.3. Damage to Forests Indonesia 76

3.3.1. Pulp and Paper Industry Expansion massive 76

3.3.2. 4 Stud Pulp and Paper 78

3.3.3. Trace the destruction of Indonesia's forests 79

3.4. Forestry industry requires investment momentum 80

3.5. Development of forest management in Indonesia 81

3.6. Utilization of the largest natural forests in Borneo 82

3.6.1. East Kalimantan has plantations

The largest 83

3.7. SOE dominance of natural forest IUPHHK 84

3.8. Chip mill's company put even more pressure on

forests and life in South Kalimantan 85

3.8.1. Supply gap 86

3.8.2. Replacing forests with wood chips 88

3.8.3. One-sided picture of village communities-

91 villages in Sea Island

3.8.4. International support 93

3.9. Amount Forest Concession Company by

94 provinces

3:10. The area of forest concession companies 95

3.11. Round Wood Production by Company Concessions

Forest Wood by Type 95

3.12. Distribution of Industrial Plantation Forest (HTI) in Indonesia 96

3.13. Indonesian National Standard (SNI) of the Forest 96

CHAPTER IV THEORY OF PULP AND PAPER INDUSTRY 105

4.1. Definition Paper 105

4.1.1. History of Paper 105

4.1.2. Nicholas Louis Robert, the inventor of the process

Papermaking 106

4.1.3. Paper size 107

4.1.4. Washi Paper 116

4.1.5. Paper Daluwang 125

4.1.6. 129 Papyrus Paper

4.2. Scope of the Pulp and Paper Industry 132

4.2.1. Pulp industry coverage 132

4.2.2. Coverage paper industry 132

4.3. Paper Industry Grouping 133

4.3.1. Upstream Industry Group 133

4.3.2. Between 133 industry groups

4.3.3. Downstream Industry Group 133

4.3.4. ISIC Industry Pulp and Paper Products 135

4.4. Pulp and Paper Industry standardization 135

CHAPTER V RAW MATERIAL AND PROCESS OF PULP

AND PAPER 137

5.1. Raw materials 137

5.1.1. Cellulose 137

5.1.2. The types of paper 138

5.2. Pulp and Paper Making Process 138

5.2.1. Pulp Making Process (Pulp) 138

5.2.2. Papermaking (paper machine) 142

5.2.3. Some facts to appreciate a piece of

Paper 144

5.2.4. Papermaking wet-dry 146

5.2.5. Drying the Fourdrinier machine 146

5.2.6. Economic aspects of 147

CHAPTER VI CONDITIONS MARKET PULP and PAPER

IN INDONESIA 150

6.1. Indonesia likely to follow in the Scandinavian Market

Paper pulp 150

6.2. Paper domestic market grew 4.2% this year 153

6.3. Sinarmas up 27 Trillion Dollar Paper Mill 154

6.4. Industry Minister learned boycott the paper by

Walt Disney 156

6.5. Printing Industry growing Negative 157

6.6. Paper and Pulp prices dropped 158

6.7. Opportunities Indonesia became a major supplier of Pulp

and Paper 159

6.8. Paper production could reach 13 million tons 160

6.9. Indonesia to Net Importer Paper 161

6:10. Pulp and Paper Green Technology needs adoption 162

6:11. Paper manufacturers have to follow the procedure of WTO 163

6:12. Pulp production rose 5.26 percent 165

6:13. Momentum resurrection Indonesian Pulp and Paper Industry 165

6:14. Import Investigations committee is Paper 167

6:15. National paper production process addresses

to our Terms of Timber Legality Verification (SVLK) 169

6:16. Taiwan to make paper from rice and wheat stalks 170

6:17. Pulp need 1.5 Million Hectares 171

6:18. Demand rose, spurring production APP 172

6:19. Eco-Labeling and Autonomy 174

6.19.1. Understanding of ECO-LABELING 175

6.19.2. History of Ecolabel 176

6.19.3. Problems with Development

Agribusiness Pulp and Paper in an Era of Eco-

Labeling and Autonomy 179

6.19.4. Results Analysis of Eco-Labeling on Industry

Pulp and Paper 181

6:20. Pulp and Paper Industry Development: Do not

Indonesia Natural Forest Sustainability interrupt 181

6.20.1. Exports and consumption of Pulp and Paper

Indonesia has increased 182

6.20.2. Pulp and Paper raw materials from natural forests

Indonesia 183

6.20.3. Realization of plantation development

Industry (HTI) is too slow 184

6.20.4. Increasingly destructive natural forest 185

6.20.5. Exit 186

6:21. Three business units awarded APP Industry

Green 2012 187

6:22. Industry Minister to address the boycott Paper

by Walt Disney 187

6:23. Sinarmas build a Rp 27 Trillion Paper Mill 188

6:24. Indonesia to Net Importer Paper 189

6:25. Construction of Asia's largest Paper Mill 190

6:26. Pulp industry requires an additional 1.5 Million Hectares 192

6:27. Paper producers must follow WTO procedures 193

6:28. Pulp and paper exports targeted to U.S. $ 2.64 Billion 194

6:29. Pulp and Paper Industry Investment attract U.S. $ 16 billion in 196

6:30. Most Employers complain Pulp and Paper

lack of supply of raw materials 197

6:31. World markets rely on wood from Indonesia 198

6:32. Pulp and paper exports predicted to grow by 4% 200

6:33. Widespread industrial timber estates (HTI) down, Forests

People's up 202

6.33.1. Value Investment in Forest Industry

rose 10% 203

6.33.2. Forestry: TLVS not hinder performance

204 Indonesian timber exports

6:34. Indonesian industry will not be able to predict

work opportunities in the Asia Pulp and Paper 206

6:35. Production targets will RAPP stagnant 2.8 million tons 207

6:36. Paper Industry investment is expected to rise 8% 208

6:37. Pulp and Paper, exports of non-oil commodities mainstay

Indonesia 209

6:38. Paper Mill development â € œOKI Pulp and Paper Millsâ €,

largest in Asia 211

6:39. Paper and Pulp Industry Boost 213 Production

6:40. The paper industry is expected to increase 8 percent

year 2013 215

6:41. Pulp and Paper Entrepreneur ask the Government,

that Rule 216 clarified Timber Legality Verification

6:43. Pulp and Paper Entrepreneur, complained about the lack

Wood raw material supply 220

6:44. Buffeted by rumors, paper exports rose 222

6:45. Environmental Issues International NGO weakening exports

Paper 223

6:46. Demand up, ramped APP 224

6:47. Taiwan firm to make paper from rice and

226 wheat stem

6:48. Momentum resurrection Pulp and Paper Industry

Indonesia 227

6:49. Paper production could reach 13 million tons 229

6:50. Paper mill owned by Prabowo largest ASEAN 230

6:51. Industry Tobacco (Smoking) 243

6.51.1. Development of Export Value Tobacco 243

6.51.2. Trend Tobacco Exports 243

6.51.3. Development Tobacco Exports Volume 243

6.51.4. Trend Tobacco Exports Volume 243

6.51.5. Development Tobacco Import Value 244

6.51.6. Trend Import Value Tobacco 244

6.51.7. Development Tobacco Import Volume 244

6.51.8 The number of workers on

Tobacco Industry and Cigarette 244

6.51.9. Trend amount of labor in industry

Tobacco and Cigarette 244

6:51:10. Development Cigarette Exports Value by

Country of Destination 245

6:51:11. Development of the Cigarette Industry Import Value

by Country of Origin 246

6:52. 247 Carton Packaging Industry

6.52.1. Anthoni Salim Cooperate with Japan Operate

251 Carton Packaging Factory

6.52.2. Seeing as the packaging business opportunities

252 profitable business

6:53. List of Pulp and Paper Industry, Capacity

Installed and Product Type 257

CHAPTER VII PULP INDUSTRY OUTLOOK AND CHALLENGES

AND PAPER INDONESIA 265

7.1. Indonesian paper industry is still prospective 265

7.2. Global Trends 266

7.2.1. The trend has been going on 266

7.2.2. The trend is going to happen 267

7.2.3. Analysis of trends

has and will occur in the development

270 Paper Industry

7.3. Problems faced Paper Industry 271

7.4. Competitiveness Factors 273

7.4.1. Supply and Demand 273

7.4.2. The condition factor (Input) 275

7.4.2.1. Natural Resources 275

7.4.2.2. 277 Capital Resources

7.4.2.3. Human Resources 278

7.4.2.4. Infrastructure 278

7.4.2.5. Technology 279

7.5. Industrial Core, Supporting and Related 280

7.6. Entrepreneurs and Corporate Strategy 280

7.7. SWOT Analysis 281

7.7.1. Strength of 281

7.7.2. Weaknesses 281

7.7.3. Opportunities 281

7.7.4. Threats 282

7.8. Target 282

7.8.1. Medium Term (2010-2014) 282

7.8.2. Long-term (2010-2025) 283

7.9. Strategy and Policy 283

7.9.1. Vision and direction of development of 283 Paper Industry

7.9.2. Achievement Indicators 284

7.9.3. Stages of Implementation 284

7:10. Program 286

7.10.1. Medium Term (2010-2014) 286

7.10.2. Long-term (2010-2025) 286

7:11. 291 Institutional

7:12. List of Companies / Manufacturers Industrial Board 291

7:13. List of Companies / Manufacturers Cigarette Paper 294

7:14. List of Companies / Manufacturers of Corrugating Medium 294

7:15. List of Manufacturers Joss Paper 296

7:16. List of Manufacturers Kraft Liner and Fluting 297

7:17. List of Companies / Manufacturers Newsprint 299

7:18. List of Companies / Manufacturers Printing / Writing Uncoated 300

7:19. List of Companies / Manufacturers Printing / Writing Coated 301

7:20. List of Manufacturers Sack Kraft (Paper Cement) 302

7:21. List of Manufacturers Security Paper 302

7:22. Specialty Paper Manufacturer List 303

CHAPTER VIII THE EXPORT-IMPORT AND PERFORMANCE

PULP and PAPER INDUSTRY 304

8.1. Pulp 304

8.2. Paper 304

8.2.1. Paper Culture 304

8.2.2. Paper Industry 305

8.2.3. Tissue Paper 306

8.3. Realization of Production 306

8.3.1. Pulp 306

8.3.2. Paper 307

8.4. Performance Index 308 Pulp and Paper Industry

8.5. Import Monitoring Sub Group Industrial Products

Paper Culture 311

8.6. Import Monitoring Sub Group Industrial Products

Goods of paper / paperboard 313

8.7. Commodity Exports pulp Industry Results

To State 315

8.8. Pulp Commodity Imports of Industrial Products

from 319 Countries

8.9. Commodity Exports paper Industry Results

To State 323

8:10. Commodity Imports paper Industry Results

from 335 Countries

8.11. Indonesian Pulp Exporter Company 348

8:12. Indonesia Exporter Company Paper 351

8:13. Import Monitoring Group 31 Industrial 377 Results

8:14. The Development of Large Industrial Production and

Moderate Indonesia 379

8:15. Realization of the Pulp and Paper Exports to the United States

(Million U.S. $) 404

CHAPTER IX REALIZED INVESTMENT IN INDUSTRY

PULP and PAPER 405

9.1. Paper Industry investment is estimated to grow 8% 405

9.2. Foreign Direct Investment Realization by

Investment Activity Report (LKPM)

by Sector Fourth Quarter 2012 409

9.3. Foreign Direct Investment Realization by

Investment Activity Report (LKPM)

by Location Fourth Quarter 2012 412

9.4. Foreign Direct Investment Realization Based

Investment Activity Report (LKPM)

State according to Fourth Quarter 2012 416

9.5. Domestic Direct Investment Realization by

Investment Activity Report (LKPM)

by Sector Fourth Quarter 2012 423

9.6. Domestic Direct Investment Realization by

Investment Activity Report (LKPM)

according to the location of Fourth Quarter 2012 427

CHAPTER X ERA ECO-LABELING AND REGIONAL AUTONOMY 431

10.1. Definition of Eco-Labeling 431

10.2. History of Ecolabel 432

10.3. Problems with Pulp and Agribusiness Development

Paper in an Era of Eco-Labeling and Autonomy 435

10.4. Pulp and Paper Manufacturers Indonesia's

Ecolabel has implemented 437

CHAPTER XI AND PULP INDUSTRY

PAPER WORLD 439

11.1. Business Opportunities (Pulp and Paper Sector in India) 453

11.1.1. Developing markets for Paper 453

11.1.2. Focus 453

11.1.3. Factor behind the growth of 454

11.1.4. Industry Overview 455

11.2. Pulp and Paper Outlook sector of Canada, 2011-2020 457

11.3. Brazilian Pulp and Paper Industry 476

11.4. Pulp and Paper Industry in China 489

CHAPTER XII THE GOVERNMENT INDUSTRIAL POLICY

PULP AND PAPER 491

12.1. Green Industry: Government Push Application

Industry Pulp and Paper Green for 491

12.2. Decree of the Minister of Forestry of the Republic of Indonesia

No.. SK.101/Menhut-II/2004 on Acceleration

Forest Plantation Development for Compliance

Raw materials 492 Pulp and Paper Industry

12.3. Center for Strategic Plans Pulp and Paper

501, 2010-2014

CHAPTER XIII THE POTENTIAL ENERGY CONSERVATION AND REDUCTION

ON SOME MANUFACTURERS INDUSTRY EMISSIONS

PULP and PAPER 509

13.1. Energy Savings Opportunities in the Pulp Industry

and Paper 509

13.2. Potential Energy Consumption and Emission Reduction in

513 Pulp Industry

13.2.1. Tanjung Enim Lestari 516

13.2.2. Toba Pulp Lestari 518

13.3. Potential Energy Conservation and Emission Reduction

521 in the Paper Industry

13.3.1. Adiprima Suraprinta 523

13.3.2. Aspec Kumbong 526

13.3.3. Bekasi Teguh 529

13.3.4. Fajar Surya Wisesa 532

13.3.5. Indah Kiat â € "535 Attack

13.3.6. Pakerin 538

13.3.7. Pindo Deli 540

13.3.8. Pura Nusa Persada 542

13.3.9. Pura Barutama 545

13.3.9. Surya Zigzag 548

13.4. Potential Energy Conservation and Emission Reduction in

Integrated Pulp and Paper Industry 551

13.4.1. Indah Kiat Pulp and Paper 553 Perawang

13.4.2. Papyrus manuscripts 555

13.4.3. Mainstay Riau Pulp and Paper 557

CHAPTER XIV RESEARCH AND TECHNOLOGY DEVELOPMENT

PULP, PAPER, AND CELLULOSE derivatives

ENVIRONMENT 558

14.1. Standardization of Facilities Research and 558

14.2. Research 563

CHAPTER XV WASTE PULP AND PAPER INDUSTRY 568

15.1. Industrial Waste Rules: Law No.

32/2009 on the Protection and Management

Environment 568

15.2. Business World objection RPP 569 B3

15.3. Asia Pulp and Paper Technology has Filters

Water IPAG60 571

15.4. Utilization of solid waste mixed with leachate

black as a Bio Briquette 571

15.5. The concept of Zero Waste 580

CHAPTER XVI THE USE OF RAW MATERIALS AND PULP INDUSTRY

PAPER IN LARGE SCALE 585

16.1. World focus on Indonesia HTI 587

16.2. Forest Area and Utilization 590

16.2.1. Vast Indonesian Forest 592

16.2.2. Development Trend Development IUPHHK-

Natural Forests and Plantations 593

16.3. Pulp and Supplies Raw Materials 597

16.3.1. Raw Materials for the Industry requirement Pulp

RAPP and IKPP 598

16.3.2. Comparing the contribution of HTI and Forests

Natural for PT. RAPP and PT. IKPP 609

16.4. Fulfillment of Raw Materials, and Forest Condition

Riau Natural 618

CLOSING CHAPTER XVII 622

17.1. Conclusion 622

17.2. Policy Implications 623

17.3. Prospects for the next 5 years 624

REGULATORY REFERENCE: